In-Depth Analysis by Stevanović Law Office: What’s Happening at Nestlé?

22.09.2025Written by: Miloš Stevanović

The Stevanović Law Office provides a professional legal-corporate opinion on the crisis shaking the Swiss food giant Nestlé. In September 2025, Nestlé faced a sudden shake-up in its top leadership due to a scandal that raises questions about the company's corporate culture, system of accountability, and the sustainability of its governance model. Below, we analyze the background of the events — the urgent dismissal of the Chief Executive Officer and the Chairman of the Board — as well as the potential legal liability of management, the systemic unsustainability of the current governance structure, and possible regulatory and reputational consequences. Finally, we consider potential changes in response to the crisis, from the perspective of legal standards of corporate governance.

Background of the Scandal: Dismissal of the CEO and Chairman of the Board

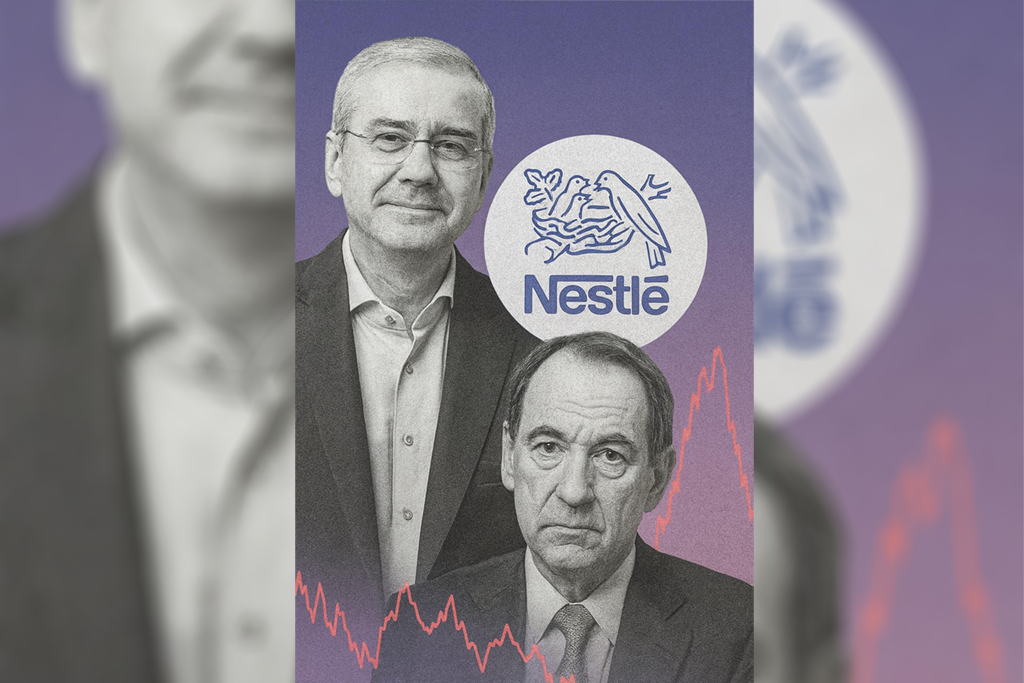

At the center of the crisis is the dismissal of Chief Executive Officer (CEO) Laurent Freixe for violating internal rules. At the beginning of September 2025, Nestlé urgently dismissed its CEO following an internal investigation that confirmed Freixe had a secret “romantic relationship” with a directly subordinate employee, thereby breaching the company’s code of conduct. This decision was necessary, as stated by Chairman of the Board Paul Bulcke, given that “values and good governance are the foundation of our company.” This marked the end of Freixe’s short one-year tenure as head of Nestlé (he had assumed the role in September 2024 after his predecessor Mark Schneider was forced out due to poor performance). Nestlé emphasized that the misconduct of the new CEO represented a clear violation of the code and that the reasons for his dismissal were entirely separate from those of his predecessor’s departure.

The consequences of the scandal did not stop with the CEO. A few weeks after Freixe’s departure, under investor pressure, Chairman of the Board Paul Bulcke also resigned. Investors – confronted with the fact that two chief executives had been dismissed within just over a year – openly questioned Bulcke’s leadership and judgment in crisis situations. In fact, shareholders told the Financial Times that Freixe’s dismissal, and the way the investigation against him was handled, further deepened their concern about corporate governance at Nestlé. Some influential investors believe Bulcke should have stepped down already when Mark Schneider was dismissed last year. It is worth noting that Bulcke is a Nestlé veteran (he joined the company in 1979, served as CEO from 2008 to 2016, and became Chairman of the Board in 2017), and his long-standing dominance at the top of the company is now being challenged. His support had already been declining – at the 2025 general meeting, he was re-elected with 84.8% of the vote, compared to nearly 96% support in 2017 – reflecting growing shareholder dissatisfaction.

Nestlé appointed an experienced internal executive, Philippe Navratil, as the new CEO immediately after Freixe’s dismissal. At the same time, it was announced that Pablo Isla (former head of Inditex and previously an independent director at Nestlé) would take over as Chairman of the Board – completing the reconstruction of the company’s leadership and ensuring a fresh perspective in governance. These swift appointments were aimed at bringing stability and showing the market that the company continues to operate smoothly, although the reputational damage had already been done (Nestlé’s stock briefly fell by about 2% upon news of the scandal, alarming investors).

Corporate Culture Under Scrutiny and Management Responsibility

The “Freixe case” has raised serious questions about corporate culture within Nestlé and the accountability of top executives. On paper, Nestlé has long emphasized that its corporate values are based on respect, integrity, and fairness – which implies zero tolerance for conflicts of interest and abuse of power. However, the revelation that the CEO himself violated these principles signals a potential failure in applying them in practice at the highest level. Such behavior by the head of the company inevitably affects the broader organizational culture: if the top of the pyramid does not follow the rules, it sends a poor message to the rest of the staff.

An inappropriate romantic relationship between a CEO and a subordinate carries a range of potential legal liabilities. First, there is a risk of lawsuits – both from employees (due to possible bias, favoritism, or even justified claims of harassment) and from shareholders for breach of fiduciary duties by management. Experts note that such situations can harm workplace culture and the company’s reputation, and raise the question of whether the CEO’s decisions were driven by personal interests rather than the best interest of the company. In other words, every business decision made by a compromised executive can be questioned: for example, were certain promotions, salary increases, or even choices of suppliers and partners based on objective criteria or inappropriate private relationships?

From a corporate law perspective, Freixe’s failure to report a conflict of interest clearly constitutes a breach of his duty of loyalty to the company. Precisely because of such risks, companies implement codes of conduct and internal policies that explicitly require senior management to report any circumstance that may affect their impartiality (including intimate relationships with subordinates). Even the Financial Times editorial commented on the case, reminding that “an office romance is board business,” i.e., senior executives must transparently inform the board about such relationships. In this particular case, Nestlé formally adhered to its rules – an investigation was conducted, a breach of the code was established, and the CEO was immediately dismissed. Moreover, the unusually harsh decision was made to deny the dismissed CEO a severance package, emphasizing the seriousness of the offense and the company’s intent to send a clear message about behavioral standards. (Note: withholding an agreed “golden parachute” for a CEO is a rare move in corporate practice, possible only in cases of termination for cause, i.e., deliberate breach of obligations by the executive.)

However, the question arises whether Nestlé's response was timely. According to available reports, suspicions about Freixe’s behavior emerged much earlier: the first anonymous complaint about his relationship with a subordinate was received as early as the end of 2024 through the internal whistleblower channel. Although the initial internal investigation found no evidence and the matter was temporarily archived, subsequent new allegations – including claims of favoritism and conflict of interest – led to a reopening of the investigation, this time with the engagement of an external independent advisor. The investigation was personally overseen by Chairman Paul Bulcke and lead independent director Pablo Isla. Critics, however, argue that Bulcke should have reacted earlier and more decisively: according to Financial Times, he ignored earlier internal board advice to remove Freixe as soon as suspicions emerged. If it is true that company leadership hesitated to act immediately on early warnings, this raises questions of responsibility and potential breach of the board’s duty of care. Any delay in resolving such an issue exposed the company to prolonged legal (if the prohibited relationship increased potential damage or legal grounds for claims) and reputational risk (if the information leaked before the company responded). The board has a fiduciary duty to protect the interests of the company and its shareholders, so it will certainly be scrutinized whether that duty was fulfilled appropriately in this case. There is no doubt that the coming period will bring deeper analysis of Nestlé’s internal controls and the management’s readiness to address ethical issues in its own ranks in a timely manner.

Systemic Issues in Nestlé’s Governance Structure

This crisis is not merely the result of individual moral failure but points to deeper systemic weaknesses in Nestlé’s corporate governance. First and foremost, the dismissal of two consecutive CEOs within just one year signals an unstable succession system and possibly poor strategic leadership by the board of directors. According to media reports, Mark Schneider was forced out as CEO in August 2024 for failing to reverse a trend of business slowdown. His successor, Freixe, then implemented an almost opposite strategic approach—criticizing his predecessor’s diversification efforts and returning to the so-called “business fundamentals.” This kind of strategic discontinuity—from rapid portfolio expansion to a sudden “back-to-basics” approach—creates confusion within the corporation and the market and suggests that the board has not established a consistent long-term vision. Constant shifts in company direction with each new CEO is a sign of deep structural instability.

Moreover, the fact that Paul Bulcke remained chairman of the board for nearly a decade after stepping down as CEO raises questions about corporate governance practices in terms of supervisory independence. As a former long-term executive, Bulcke undoubtedly had significant influence over the selection and mentoring of his successors. His dual role—as both the company’s de facto patriarch and the formal overseer as chairman—may have reduced the objectivity in evaluating executive performance. Some investors believe Bulcke’s loyalty to the management team (which included his former colleagues and protégés) contributed to a reluctance to take timely action when early signs of trouble emerged. This highlights the need to refresh and professionalize the board. It is encouraging that Nestlé had previously proposed Pablo Isla—a seasoned external executive with a proven track record at another global company—as Bulcke’s successor. The arrival of an independent chairman is expected to strengthen Nestlé’s corporate governance, as Isla brings an external perspective and is unburdened by internal hierarchical ties.

However, the crisis has also exposed a broader problem with Nestlé’s conglomerate model. Over decades, the company grew into a giant with a portfolio of over 2,000 brands ranging from baby food, bottled water, and coffee to confectionery and pet food. This diversity was once seen as a strength, but in recent years it has shown signs of strain: sales growth has stagnated, operating costs have risen, and the company’s stock value has dropped by around 40% since 2022. Nestlé’s net debt has risen to over three times EBITDA, exceeding the leverage of rivals like Unilever. Investors and analysts are openly questioning whether Nestlé has become too slow and cumbersome due to its size, calling for a more focused business approach. One analyst vividly noted that “size alone is no longer a guarantee of success in the food industry,” and that Nestlé can only reignite growth through a “more focused portfolio and targeted acquisitions.” Some competitors are already restructuring—for instance, Kraft Heinz split into separate units to increase value, while activist fund Elliott Management has invested billions into PepsiCo with the intent to push for change. In this environment, instability at Nestlé’s top leadership has further shaken investor confidence in its current conglomerate model. Shareholders have publicly demanded “urgent and necessary restructuring”—cost reductions, potential divestitures, and a focus on core brands to improve efficiency.

From a sustainability perspective, it’s clear that Nestlé’s current governance structure needs rethinking. A better balance between continuity and change is required. After decades of internal appointments, Nestlé may need to look externally for top talent—either through appointing independent directors, hiring external executives, or engaging consultants for organizational redesign—to break the homogeneity of thinking. Enhancing the succession plan will also be considered, such as formally introducing a Deputy CEO or Chief Operating Officer role to ensure a smooth leadership transition in the event of an unexpected departure (as has proven useful in this case). The board will also need to audit the effectiveness of current oversight mechanisms, such as the internal “whistleblowing” system, and assess whether red flags are being acted upon decisively. Ultimately, the crisis has shown the need to reinforce a culture of accountability at all levels—from the top down.

Legal, Regulatory, and Reputational Risks

When a corporation of this scale experiences a public scandal at the top, the legal and regulatory consequences can be significant. Although an undisclosed relationship is not a criminal offense, the company may face regulatory scrutiny over its corporate governance. Capital market regulators may investigate whether Nestlé adequately informed investors about material information—for example, whether there was any concealment of facts that could have affected the stock price. In this case, the CEO’s dismissal due to code of conduct violations caused a minor share price drop, but had the information leaked earlier or been disclosed untimely, Nestlé could face accusations of misleading the market. Additionally, corporate regulators (in Switzerland or other jurisdictions where Nestlé is listed) may request reports on how the board responded to internal reports and whether internal rules and best practice standards were upheld. Already, Swiss business circles are discussing “weaknesses in governance and succession planning” that have surfaced, which will likely lead to increased scrutiny of Nestlé going forward.

Beyond the internal scandal, Nestlé is also facing external legal challenges. In July 2025, French authorities raided Nestlé offices as part of an investigation into allegedly unlawful water filtration methods in its bottled water business. This incident suggests potential problems in the company’s culture and oversight may extend further—from internal ethical breaches to compliance with health and environmental regulations in the supply chain. If any part of the business is found to have broken the law—whether through management negligence or a culture of “looking the other way”—legal consequences could include regulatory penalties, hefty fines, and even criminal liability for individuals. Nestlé has previously faced criticism over sourcing practices (e.g. sustainability of raw materials, supplier relations in developing countries), and any new scandal can quickly revive calls for boycotts or stricter oversight. The reputation of brands like KitKat and Nescafé depends heavily on public perception of the company’s ethics. In that sense, the recent events have damaged Nestlé’s image as a stable and reliable business entity.

The silver lining is that Nestlé has shown some degree of organizational resilience by activating its internal controls: an anonymous employee report (via the “Tell Us” platform) triggered an investigation, and the board—though delayed—ultimately took decisive action by dismissing the CEO and sanctioning the misconduct. This swift response could partially limit the reputational damage—it demonstrates that no one, not even the CEO, is above the rules. From a governance standpoint, this is an important signal to stakeholders and regulators. According to reports, investors tend to focus on the company’s long-term performance rather than dwelling on short-term bad publicity—provided that corrective measures are taken. Still, reputational risk will likely persist in the medium term: media headlines such as “Meltdown at Nestlé” and “Sex scandal shakes the maker of KitKat” have inevitably tarnished the image of leadership. Competitors may take advantage of the weakened reputation, and top talent within the company could be demoralized or even consider leaving Nestlé.

Regulatory agencies will likely closely monitor how Nestlé institutionally responds to this event. In many jurisdictions, large companies are now expected to conduct internal reviews of procedures and culture following such incidents and report findings to regulators or the public. In Nestlé’s case, one can expect the formation of a special committee or the hiring of independent advisors to assess whether systemic issues exist—e.g. whether a culture of fear or apathy prevented earlier problem detection or whether other latent conflicts of interest are present. Should board oversight failures be identified, board members could potentially face shareholder liability. Swiss corporate law and governance codes demand a high duty of care—intentional or grossly negligent ignoring of warning signs could be treated as a breach of duty, opening the door to derivative shareholder lawsuits on behalf of the company. For now, such scenarios remain speculative, but the seriousness of the situation requires Nestlé and its board to take proactive steps to prevent further legal escalation.

Potential Changes and Future Steps

Based on the above, it is clear that Nestlé must take concrete steps to restore trust and ensure long-term sustainability in its business and governance. Based on available information and comparative corporate practice, AK Stevanović outlines the following potential avenues for reform:

Strengthening Corporate Governance: The arrival of Pablo Isla as chairman is already a positive development, likely to bring stricter oversight and more independent control of the executive team. A review of board composition is also recommended—introducing more independent directors with diverse expertise (e.g. compliance, ethics, sustainable supply chains) to oversee key risks. The company’s corporate governance code could be updated with clearer protocols for handling high-level ethical dilemmas, including mandatory regular reporting to the board on all misconduct complaints involving senior leadership.

Enhancing Compliance Culture and Systems: Nestlé will likely make efforts to restore employee and public confidence in its corporate culture. This includes additional training for management on conflict of interest, anti-discrimination, and general business ethics. The internal whistleblowing platform ("Tell Us") has proven effective, but additional mechanisms might be considered—such as an independent ethics ombudsman employees could contact outside normal hierarchy. Creating an environment where staff trust that even top executives can be held accountable without retaliation is crucial for a functional compliance culture.

Portfolio Reorganization and Operational Sustainability

From a business perspective, it is expected that the new CEO, Navratil, will continue and accelerate the restructuring measures already underway. A review of less profitable business segments (e.g., the vitamins and supplements division and a potential sale of parts of the bottled water business) has already been announced, with the aim of refocusing the company on its core brands and markets. These moves could reduce the complexity of the conglomerate and allow management to concentrate on core operations where Nestlé holds a competitive advantage.

At the same time, cost-saving and efficiency-enhancing measures need to be implemented—investors are openly demanding a "leaner and more efficient" Nestlé, which implies cost optimization, and possibly a reduction in workforce redundancies or excessive bureaucracy within central structures. A restructuring of this scale should be carried out with careful legal planning, taking into account labor law (in case of layoffs) and contractual obligations to partners and suppliers (in case of unit divestments or changes to cooperation terms).

Business Continuity and Succession Planning

After two consecutive unplanned CEO departures, Nestlé will aim to avoid a similar scenario in the future. It is possible that a formal position of Deputy CEO or Chief Operating Officer will be established—someone who could step in to lead the company in case of a sudden crisis (as has also been suggested in expert analyses). This would provide greater continuity and reduce the shock to the company and the market in the event of abrupt leadership changes.

Additionally, the board is likely to pay more attention to succession planning going forward: identifying and developing potential future leaders, including the possibility of considering candidates from outside the traditional Nestlé ecosystem to bring in fresh ideas.

Proactive Communication and Regulator Relations

In a situation of damaged reputation, Nestlé must communicate transparently about the steps it is taking. The public, investors, and regulators should be reassured that the company has learned lessons from this crisis. This could include publishing a report on corporate culture following an internal review, publicly reaffirming its commitment to the highest standards of business ethics, and even launching initiatives such as roundtables or conferences where Nestlé would share its experiences and promote the importance of ethical leadership in corporations.

Cooperation with regulators should be open and constructive—for example, by offering regular updates on the implementation of recommended improvements, in order to avoid imposed sanctions.

Conclusion

In conclusion, Nestlé finds itself at a crossroads, where a combination of legal, governance, and strategic actions will determine the direction of its further development. A crisis triggered by the personal misconduct of a single executive has evolved into a broader story about how the structure of one of the world’s largest corporations may have become unsustainable without reform.

From a legal standpoint, it is encouraging to see that mechanisms of accountability have indeed been activated—the responsible individuals have been sanctioned, and important questions have been raised—which, in the long term, strengthens the rule of law within the corporation.

Now, Nestlé must prove through concrete actions that it can implement the necessary reforms. A successful recovery from this situation could serve as an example for other global companies of just how important strong ethical foundations and adaptable governance structures are in facing crises. If, however, substantive changes fail to materialize, Nestlé risks further erosion of trust—both from the markets and regulators, as well as from consumers who have remained loyal to its products for generations.

AK Stevanović will continue to monitor developments, with the hope that the world’s largest food producer emerges from this crisis strengthened and renewed, founded on the principles of good corporate governance.

/ / /

"Standard Prva" LLC Bijeljina is a company registered in Bijeljina at the District Commercial Court in Bijeljina. Company’s activities are accountancy, repurchases of receivables, angel investing and other related services. Distressed debt is a part of the Group within which the company repurchases the receivables, which function and are not returned regularly.

Lawyer’s Office Stevanović is the leading lawyer’s office in the region with the seat in Bijeljina. The LO abbreviation represents Lawyer’s Office of Vesna Stevanović and Lawyer’s Office of Miloš Stevanović.

Contact for media press@advokati-stevanovic.com or via telephone 00 387 55 230 000 or 00387 55 22 4444.