Study: How ESG Divides the EU and the USA

06.09.2025by: Miloš Stevanović and Sabina Brkić

What is ESG and why is it important?

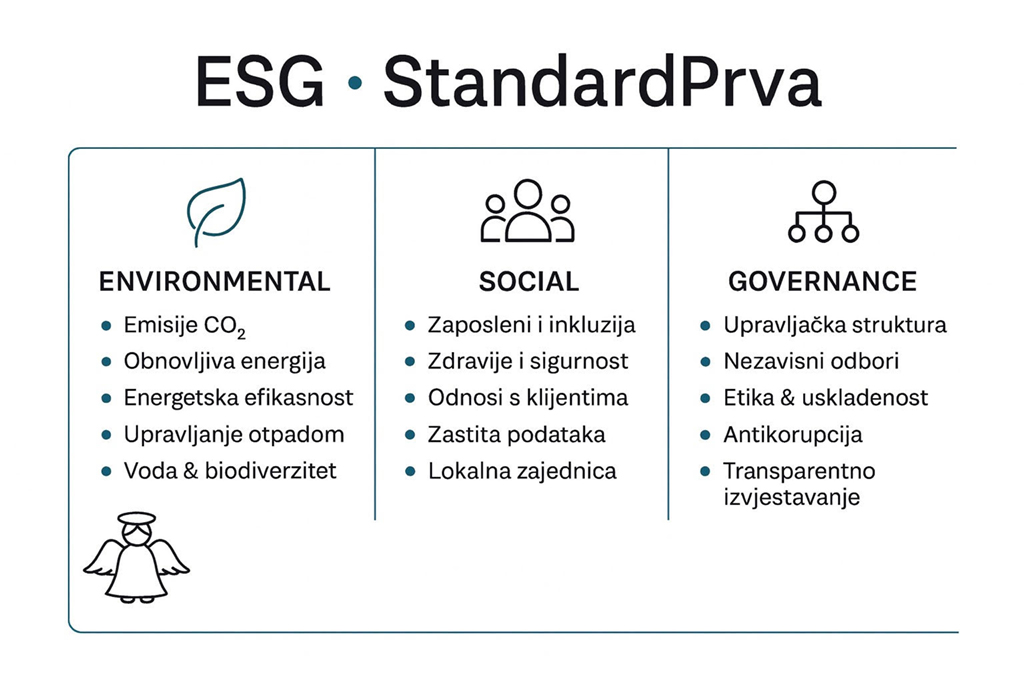

ESG represents the criteria Environmental, Social, Governance which are used to assess the sustainability and ethical impact of a company’s operations. ESG is a framework that helps stakeholders understand how an organization manages risks and opportunities related to sustainability in the fields of environmental protection, social responsibility, and corporate governance. This concept has in recent years become a central part of finance – it has changed the way many of the largest financial institutions and funds make decisions about capital allocation. In other words, more and more investors, clients, and regulators are paying attention to the ESG performance of companies, considering that issues such as climate change, employee relations, or business ethics can significantly affect long-term financial success and risk.

The importance of ESG in finance has sharply increased in the past decade. Since the adoption of the Paris Agreement in 2015, sustainable investing and ESG factors have come to the forefront of global discussions on responsible investment. Hundreds of new investment funds have been launched focusing on companies that operate in accordance with ESG principles, which testifies to the growing popularity of this approach. Investors are striving to align their portfolios with their values and to avoid companies that harm the environment or society. At the same time, it is believed that good ESG indicators can also mean more stable, resilient business – for example, enterprises that responsibly manage waste and emissions can avoid regulatory fines, while those with good employee relations face less risk of scandals. Thus, ESG becomes a factor that can influence a company’s reputation, access to capital, and long-term returns.

However, it should be noted that the rapid growth of ESG investing is also accompanied by debate. Certain critics on both sides of the political spectrum question the actual impact of the ESG approach. Some institutional investors (e.g., pension funds) fear that strict adherence to ESG criteria could conflict with the fiduciary duty of maximizing profits – pointing out that the focus on sustainability must not reduce returns for savers. On the other hand, sustainability advocates warn about the appearance of “greenwashing,” i.e. falsely presenting a business as “green” and responsible without real substance. While some claim that ESG contributes to long-term better financial performance of companies, others emphasize that the evidence for this is still mixed and insufficiently clear. Despite these debates, ESG has undoubtedly become a significant factor in the financial world – significant enough to generate both great support and strong resistance, as will be shown by the comparative analysis between the EU and the USA.

The European Approach: Regulation and Support for ESG Investments

The European Union has positioned itself as a global leader in the integration of ESG principles into the financial system. EU institutions openly favor sustainable investing, supported by a whole range of laws, policies, and strategies. The European Green Deal of 2019 set an ambitious framework for the transition to a sustainable economy – including goals of reducing pollution, protecting biodiversity, decarbonizing energy, and sustainable agriculture. As part of this broad initiative, the Action Plan for Sustainable Finance was also established, accompanied by concrete regulations that promote ESG investments and prevent “greenwashing.” One of the key ones is the Sustainable Finance Disclosure Regulation (SFDR), which came into force in 2021 and required investment funds and financial advisors in the EU to clearly inform investors about how they integrate ESG risks into their decisions. The goal of SFDR is to increase transparency and accountability, to ensure that funds truly do what they preach in terms of sustainability.

After that, the EU also adopted the Corporate Sustainability Reporting Directive (CSRD), which introduces standardized and mandatory ESG reporting for large enterprises. CSRD, announced in 2023 and implemented from 2024, requires companies to publish detailed data on their impact on the environment, society, and governance, according to unified European standards. The aim is to enable investors to easily compare the ESG performance of companies and prevent non-financial information from being hidden or embellished. Another important pillar of European ESG regulation is the EU Taxonomy adopted in 2020 – a unique classification system that defines which economic activities are considered environmentally sustainable. The taxonomy provides clear criteria (e.g., how much greenhouse gas emissions per unit of product are acceptable), helping investors direct capital into truly “green” projects and preventing harmful activities from being falsely presented as sustainable. In addition, the EU launched the Investment Plan for the European Green Deal, under which a quarter of the Union’s budget until 2027 is to be directed toward climate and environmental goals – including subsidies for renewable energy, energy efficiency, green infrastructure, etc. This scope of financial support clearly shows the EU’s strategic commitment to sustainability.

Regulatory and institutional support for ESG in Europe goes beyond EU-level regulations – many member states incorporate ESG principles into national laws. For example, in the Netherlands the new Pension Act requires pension funds to report how they take environmental, social, and governance factors into account in their investment policies. Similarly, European financial supervisory authorities (ESMA, EBA, etc.) issue guidelines that integrate ESG risks into the risk management of banks and insurance companies. Why is the EU doing all this? One reason is certainly that European leaders and the public see ESG as a means for long-term sustainable and stable development. Investing in “dirty” industries is considered risky not only for the environment but also financially – because in the long run those businesses may become unsustainable due to stricter regulations or changes in consumer preferences. It is therefore not surprising that many large European investors openly support ESG. For example, despite some global fatigue around sustainability, the largest Dutch pension funds still consider sustainable investing “the best long-term approach” to achieve stable returns with acceptable risks. In short, in Europe there is broad consensus – from lawmakers to investors – that the integration of ESG criteria helps the financial system to be more resilient, transparent, and aligned with social goals.

The American Approach: Political Division and Resistance to ESG

In contrast to the EU, the United States does not have a unified and coherent approach to ESG standards at the federal level. Regulation is fragmented, and attitudes toward sustainable investing are deeply divided along political lines. While the EU has strongly moved toward mandatory ESG reporting, in the USA the framework is mostly voluntary and depends on the initiatives of individual companies or investors. Administrative changes in the White House have also led to dramatic shifts in federal policy toward climate and ESG issues. Thus, in 2017 the then administration withdrew from the Paris Agreement and blocked any progress in ESG regulation under the pretext of protecting the economy. Only in 2021, with rejoining the Paris Agreement, did the USA formally return to global sustainability efforts, but even under that administration many initiatives faced resistance. The U.S. Securities and Exchange Commission (SEC) announced in 2021 the formation of a special task force for climate and ESG issues to detect fraud and omissions in these areas, and also proposed a rule on mandatory disclosure of climate risks for companies. However, due to political pressures, even the SEC has in recent times slowed down or paused some of those initiatives (e.g., delaying the implementation of climate reporting rules). In general, at the federal level the USA mostly relies on voluntary standards and market practices, such as the Global Reporting Initiative framework or SASB standards, instead of comprehensive laws as in the EU.

What most characterizes the American ESG landscape is strong politicization. ESG has in the USA become a kind of “political lightning rod” – a topic that provokes opposing ideological reactions. While more liberal circles and some states see sustainable investing as desirable and modern, the conservative part of the political spectrum increasingly attacks ESG as the imposition of a “progressive agenda” on corporations. Numerous states led by Republicans in the past few years have introduced laws that actively discourage or even ban the application of ESG criteria in managing public finances. This wave of “anti-ESG” legislation is motivated by claims that ESG is contrary to financial interests and represents the politicization of investments. For example, in Texas in 2021 a law was passed prohibiting state and local institutions from doing business with banks or asset managers who allegedly boycott the fossil fuel industry for ESG reasons. In practice, Texas created a list of companies suspected of avoiding investments in oil and gas and prevented them from participating in state investments or public tenders unless they renounce such practices. Similarly, West Virginia in 2024 banned banks that integrate ESG criteria into their operations from doing business with state authorities at all. Governors and legislators of these states accuse ESG policy of threatening traditional industries (such as coal mining, oil, or weapons manufacturing) and argue that the duty of managers of public funds should be exclusively maximizing returns, not “social engineering.” Illustrative is the statement of Florida’s chief financial officer, who regarding the withdrawal of funds from ESG funds said: “Using our money to finance BlackRock’s social engineering project is not something Florida agreed to. It has nothing to do with maximizing returns and is contrary to what we pay asset managers for.” Such rhetoric, where ESG is called a “woke” agenda or ideological deception, has become common in conservative circles. Its consequence is that at least five states under Republican control (including Texas, Florida, West Virginia) have legally restricted the use of ESG factors in investing public funds. Some of them (such as Louisiana and Missouri) directly withdrew state funds from funds managed by BlackRock and similar firms accused of “ESG policy.” In contrast, several Democrat-leaning states (e.g., New York, California, Colorado) adopted measures supporting the integration of ESG criteria – either through regulations requiring state pension funds to consider climate risks, or through resolutions calling for divestment from industries harmful to society and the environment. Currently, according to data from September 2023, about 8 states actively promote ESG investments, but they are far outnumbered by over 20 states that have adopted some form of anti-ESG law. This sharp division at the level of federal states creates a very complex environment for the financial industry in the USA – companies and funds practically have to balance between opposing requirements, depending on whether they operate in “red” or “blue” states.

Reasons why part of the American actors reject ESG are, therefore, multiple.

Political ideology plays a big role: conservatives claim that corporations should focus exclusively on profit for shareholders, and not on “imposed” social goals. From that perspective, ESG criteria are viewed as an attempt at controlling the private sector by liberal policies (e.g., climate activists) and as a threat to the free market. On the other hand, there is also the economic argument – some financial executives and politicians believe that ESG investments may lead to weaker returns, because they exclude profitable (albeit environmentally harmful) projects. Pension funds in some states emphasize their fiduciary duty: if a sustainable investing strategy potentially means missing out on earnings from investments in oil companies or similar, they will not accept it. Also, protection of local industries should be mentioned as a motive – states whose economies rely on fossil fuels or similar sectors see ESG as a direct attack on those industries. For their politicians, the decision of banks to, for example, reduce lending to coal-fired power plants or oil drilling represents a threat to jobs and revenues, and they respond with countermeasures (boycott of “green” banks, threats of antitrust investigations, etc.). In short, in the American debate on ESG, ideological conflict and struggle for economic interests have become intertwined – which has led to ESG in the USA today being the subject of controversies that in Europe almost do not exist.

Examples from the USA: Withdrawals from ESG initiatives and controversies

Current news from the United States is marked by increasingly frequent examples of financial institutions withdrawing from ESG investments or initiatives, as well as conflicts over non-compliance (or compliance) with ESG principles. We will list several of the most striking cases that illustrate this trend:

Florida versus BlackRock: At the end of 2022 Florida announced that it was withdrawing about 2 billion dollars of state investments managed by BlackRock – the world’s largest asset manager – due to, as they stated, disagreement with that fund’s policy on sustainable investing. This decision of Florida, the largest such until then, was explained by the position that BlackRock puts too much emphasis on social and climate goals at the expense of financial return. Florida thus joined a group of conservative states (including West Virginia, Louisiana, Missouri) that have withdrawn at least 3.3 billion dollars in total from funds under BlackRock’s management because of its ESG orientation. These states openly state that they will punish financial institutions they believe “put social agenda ahead of profit.”

Texas and the “blacklist” of banks: Texas, as mentioned, by law prohibited cooperation with financial firms accused of boycotting the oil industry. The consequence was that some large banks and investment funds were excluded from issuing bonds and other lucrative deals in Texas. At the same time, the Texas state treasurer put more global investors – among them BlackRock – on the blacklist, accusing them of withdrawing capital from fossil fuels because of ESG pressure. (Interestingly, in June 2023 Texas subsequently removed BlackRock from that list, after lobbying and assurances that BlackRock nevertheless invests significant funds in the energy sector.) Even the U.S. Congress held hearings on the topic of ESG, where Republican representatives criticized big banks and funds for “secretly arranging climate actions” and threatened antitrust lawsuits. In that spirit, a coalition of 19 state attorneys general filed a lawsuit against the three largest asset managers – BlackRock, State Street, and Vanguard – accusing them of an alleged conspiracy to deny financing to the coal industry, which the prosecutors labeled as a violation of antitrust laws. Although this legal theory is disputed, its very emergence shows the level of resistance in part of America toward joint climate initiatives of the financial industry.

Indiana pension fund breaks with BlackRock: Another concrete example comes from the state of Indiana, whose public pension fund (INPRS) at the end of 2024 terminated cooperation with BlackRock as manager of part of its bond portfolio. This withdrawal of funds was not caused by poor performance – on the contrary, the fund staff confirmed that there were no complaints about the results of BlackRock’s strategy. The reason was exclusively compliance with Indiana’s new state law that prohibits pension funds from using managers with an ESG agenda. In other words, BlackRock was punished because at the global level it announced climate and social goals (such as achieving net-zero emissions by 2050 or supporting diversity in company boards). This is a clear signal to the financial industry – in certain American states you risk losing business if you actively promote ESG principles.

Withdrawal from climate alliances: Under the pressure of such a political climate, some large American financial institutions have also begun to withdraw from international initiatives for sustainable finance. At the beginning of 2025 there was a significant exodus of American banks from global climate coalitions. The Net-Zero Banking Alliance (NZBA) – a voluntary alliance of banks committed to achieving net-zero emissions in lending portfolios – was left by all six largest American banks: JP Morgan Chase, Bank of America, Citigroup, Goldman Sachs, Morgan Stanley, and Wells Fargo. Similarly, some of those banks also withdrew from other initiatives such as the Equator Principles (a set of standards for socially responsible project financing) and the Climate Action 100+ investor coalition. These moves signal that American banks are adjusting their course to the new political-regulatory reality – moving away from formal international ESG commitments so as not to come under fire from domestic politicians who consider such obligations undesirable. Indeed, analysts note that some banks have already started to “water down” their internal ESG programs, lowering goals for “green” lending and softening standards in the field of climate risks. This may be short-term relief for banks under pressure of regulatory easing, but in the long term it raises questions about the lag of American banks compared to European ones in terms of climate responsibility.

Investor withdrawal from ESG funds: Resistance to ESG in the USA mostly comes from the conservative side, but there are also cases where progressive investors withdraw money due to insufficient ESG performance of managers. An example of this is the Sierra Club Foundation, which in June 2025 announced that it would move about 10.5 million dollars of assets from BlackRock’s funds because it believes BlackRock is not pressing companies in its portfolio enough on climate change. In other words, this philanthropic organization (known for environmental protection) assessed that BlackRock, despite its rhetoric, did not sufficiently vote for climate resolutions at company assemblies nor sufficiently reduced investments in fossil fuels, and due to that inconsistency with ESG promises decided to sanction it by withdrawing funds. This case shows that fiduciary responsibility can also be interpreted differently – for some investors, non-compliance with ESG criteria carries reputational risk and the risk that the portfolio will lag behind in the transition to a low-carbon economy.

The above examples demonstrate how in the USA a true “war over ESG” is being waged. While some (mostly conservative politicians and related institutions) actively pull capital out of everything that carries the ESG label, others (activists and part of the investors) withdraw capital from entities they consider not genuinely committed to sustainability. Financial companies thus find themselves squeezed between two fronts – and often try to balance as best they can. The largest asset managers like BlackRock have found themselves in the crossfire: in Europe and among ESG advocates they are accused of not doing enough for sustainability, while in certain American states they are attacked for doing too much and “pushing the climate agenda.” BlackRock itself admits that it is in an unenviable position: it suffers criticism both from supporters and opponents of sustainable investing – some reproach it for insufficient support for sustainable initiatives, while others target it as a promoter of climate-focused policy. This polarization around ESG quite clearly separates the European Union and the United States, as will be seen also through the next concrete case.

European example: PFZW ends cooperation with BlackRock

To understand the essence of the transatlantic gap, it is worth looking in more detail at a case from Europe that recently made the news. PFZW, the Dutch healthcare sector pension fund (the second largest in the Netherlands, with about 250 billion € in assets), decided in 2025 to end cooperation with the American investment giant BlackRock on managing its equity portfolio. This decision resonated in financial circles because BlackRock had for many years been a significant manager of part of PFZW’s assets (about 14–17 billion dollars in index equity funds). As the reason for the termination of the mandate, the Dutch side cited disagreement over the approach to sustainability. Specifically, PFZW was concerned about the way BlackRock votes at company assemblies on ESG issues – they assessed that the American manager has a poor record of supporting climate and social resolutions at shareholder meetings. The data supported this: in 2025 BlackRock supported only 2% of shareholder proposals related to the environment and social topics, compared to 4% the previous year. In other words, instead of strengthening its commitment to sustainability, BlackRock halved it, justifying it by saying that many resolutions were “too restrictive or economically unfounded.” For PFZW and its main manager (the company PGGM) this was a red flag – they considered that a partner who does not sufficiently share their ESG values is no longer useful to them in the long term.

This decision of PFZW did not come in isolation: in the Netherlands there is an ongoing broader activist pressure on large pension funds to sever ties with managers who have reduced support for climate initiatives. The fact is that some global managers, especially in the USA, under political pressure from domestic authorities have begun to soften their green ambitions – and this has not gone unnoticed by European clients. A PGGM representative (who manages PFZW assets) told the media: “It is becoming increasingly difficult to align with American investment managers regarding voting (on sustainability).” In other words, the transatlantic gap in attitudes has become a practical problem: the European fund wants shareholder meetings to strongly support climate actions, while American partners often vote against or abstain when such resolutions are on the agenda. PFZW had already previously decided independently on its votes, but now concluded that it wants a more active investment strategy in order to be able to choose companies in line with its ESG goals and vote fully consistently with those goals. Therefore they decided to stop investing passively through BlackRock’s index funds and to transfer funds to active management with other (mostly European) managers or their internal team. In the first half of 2025 PFZW drastically reduced the number of companies it invests in – it exited as many as 2,600 firms, retaining investments only in about 750 that meet its financial and sustainable criteria. The fund’s new strategy explicitly set equal importance to financial results, risk management, and sustainability when evaluating investments. According to PFZW’s spokesperson, the goal in the next 5 years is to achieve “a better balance between the need for good returns, acceptable risks, and sustainability.”

BlackRock, expectedly, expressed regret over losing such a large client, but tried to downplay the significance of this move, stating that it still manages over 1 trillion dollars of sustainable and transition assets for clients worldwide, including a number of Dutch funds. They also reminded that clients like PFZW can themselves choose how to vote their shares if they want (which PFZW did). However, the essential message of PFZW’s move cannot be ignored: one of the largest European investors sanctioned the world’s leading investment house because it considers its approach to sustainability insufficiently strong. It is also important to emphasize the broader contrast that this case highlights: while in Europe managers lose mandates because they do not meet sufficiently strict ESG standards, in America managers lose mandates (from certain state clients) because they too actively implement ESG standards. The same BlackRock is thus criticized in the Netherlands for not being more agile in climate actions, while at the same time in the USA it is targeted by some politicians precisely because of its (relatively moderate) advocacy for climate risks in investing. Another Dutch pension fund – PME – announced a review of its cooperation with BlackRock after it withdrew from the Net-Zero Asset Managers initiative, while paradoxically some American state agencies previously considered boycotting BlackRock precisely because of that membership in climate initiatives. This “ESG paradox” best illustrates how the EU and the USA have diverged on sustainable finance: what in Europe has become normative and expected (active participation of the financial sector in sustainability), in parts of the USA has become the subject of resistance and politicization.

StandardPrva – implementation of ESG standards in practice

While a debate about ESG is being waged on the global stage, the company StandardPrva remains committed to the principles of responsible business, demonstrating how ESG standards can be successfully integrated into the everyday operations of the financial sector. StandardPrva is a company specialized in financial consulting, accounting, and advisory services, and operates according to the highest ethical and sustainable norms. As a socially responsible company, StandardPrva implements all ESG standards in its work – from internal organization to the services it provides to clients. Specifically, within the group internal policies have been adopted that cover environmental, social, and governance aspects of business. All group members apply these standards, which primarily implies a responsible attitude toward the environment: reducing the use of paper and switching to digital documentation, energy efficiency in offices, as well as audits related to waste management arising in operations. StandardPrva strives to minimize its ecological footprint and set an example for others in the financial industry that administrative activities too can be carried out in a sustainable way.

In addition to care for the environment, social responsibility is deeply embedded in the company’s culture. StandardPrva actively supports the community through financial and mentoring assistance to students, people with special needs, and other vulnerable groups, all with the aim of creating a more inclusive and sustainable environment. The company believes that people are the greatest value, and strives through employment and support to show how every individual matters and contributes to the community. It is no coincidence that StandardPrva, for the implementation of its internal ESG initiatives, chose precisely a person from a marginalized group – Miloš Pantić, a young expert who has been deaf from birth, but with his work and enthusiasm has become a key member of the team. Under his leadership as head of digitization and registry, the company is carrying out a series of changes directed toward sustainability and inclusion, proving that the social component of ESG begins with how we treat our own employees and fellow citizens. This approach confirms the reputation of StandardPrva as a responsible firm that not only provides financial services at a high level but does so in a way aligned with the highest standards of environmental protection, social care, and good governance.

As part of its mission, StandardPrva carefully monitors trends and challenges regarding ESG standardization worldwide. We are aware that the field of sustainable investing is dynamic – regulations are changing, new challenges are emerging (such as cases of non-compliance or circumvention of ESG criteria by certain financial institutions), and client expectations regarding sustainability are rising. StandardPrva strives to keep up with the latest developments: from monitoring changes in European regulations, through analysis of best practice examples, to learning from the mistakes of others (such as the above-mentioned controversies in the USA). We actively analyze cases where financial institutions did not comply with ESG criteria – whether it is greenwashing scandals, regulatory fines, or reputational consequences – in order to draw lessons from these experiences for our clients. In this way, StandardPrva can provide clients with timely and well-founded advice on how to align their business and investments with best ESG practices, but also how to avoid the pitfalls and risks of non-compliance.

Conclusion

ESG separates the EU and the USA in terms of approach and perception: while Europe treats ESG as an inseparable part of financial regulation and sustainable development, in America it has become a point of political division. European institutions and investors generally see ESG as a long-term benefit – a tool for identifying risks, improving transparency, and encouraging responsible corporate behavior that will in time bring more stable returns. In contrast, in parts of the USA ESG is viewed with skepticism or hostility, seen as a potential limitation on profit or the imposition of others’ values. This difference has led to concrete consequences: in the EU laws are passed that practically embed sustainability into every aspect of finance, while in the USA laws are passed that exclude it from certain aspects.

Nevertheless, it is worth mentioning that despite loud opposition, many American companies and investors still voluntarily apply ESG principles, aware of global trends and market expectations. On the other hand, in Europe ESG is not without challenges – the implementation of strict standards is complex and requires adjustment. In this sense, the divergence between the EU and the USA on ESG can also be seen as an opportunity for learning and cooperation: different approaches can provide insight into what works best, and future international alignment of standards could make things easier for companies operating globally.

For companies and investors, it is crucial to understand this context. StandardPrva remains committed to helping clients navigate these differences – to meet all regulatory requirements in the markets where they operate, to adopt practices that will secure them a reputation as responsible actors, and at the same time to achieve their business goals. Investing in sustainability is not a passing trend, but an integral part of modern financial strategy. The Europe–America divide in ESG approaches precisely confirms the importance of this topic: it affects company reputation, access to capital, and even geopolitical and economic relations. Accordingly, to understand ESG means to understand the future of finance – and StandardPrva is here to be a reliable guide for clients on that path, promoting the values of sustainability and responsibility wherever they operate.

Sources: This case study is based on cited sources and current data on ESG regulation and market trends in the EU and USA. The listed examples and statements are taken from credible financial publications and announcements (Reuters, Investopedia, ESG expert analyses, etc.), as indicated by references in the text. StandardPrva relies on such verified information in its work, ensuring that recommendations to clients are based on best practices and facts. In case of additional questions or need for advice regarding ESG standards and investing, we remain at your disposal as your partner in sustainable business.

/ / /

"Standard Prva" LLC Bijeljina is a company registered in Bijeljina at the District Commercial Court in Bijeljina. Company’s activities are accountancy, repurchases of receivables, angel investing and other related services. Distressed debt is a part of the Group within which the company repurchases the receivables, which function and are not returned regularly.

Lawyer’s Office Stevanović is the leading lawyer’s office in the region with the seat in Bijeljina. The LO abbreviation represents Lawyer’s Office of Vesna Stevanović and Lawyer’s Office of Miloš Stevanović.

Contact for media press@advokati-stevanovic.com or via telephone 00 387 55 230 000 or 00387 55 22 4444.