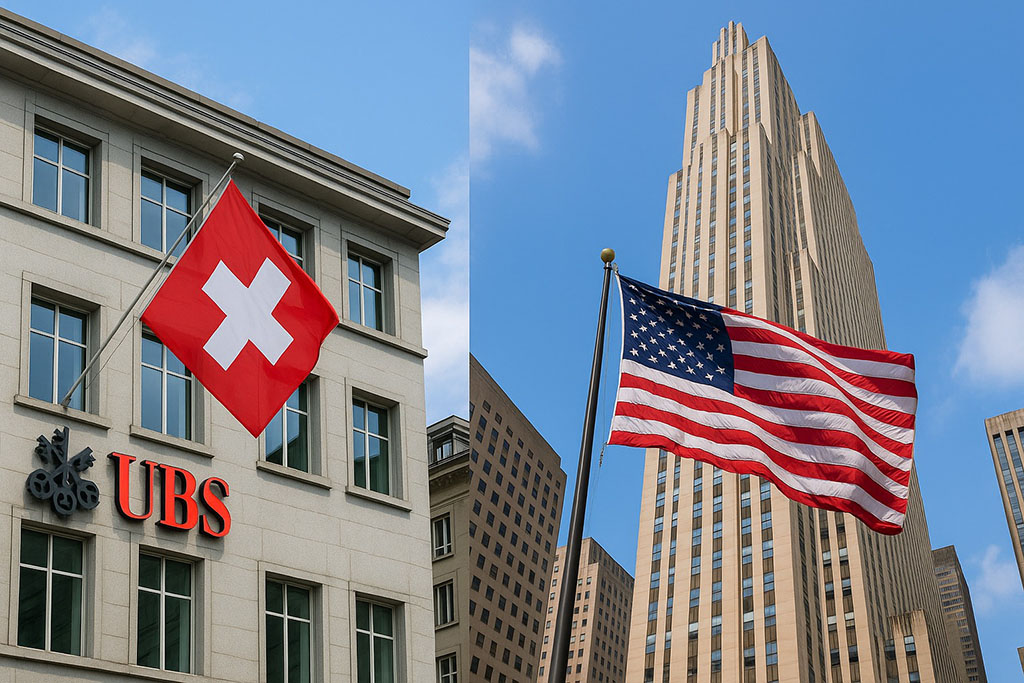

SP analysis: UBS considers relocating its headquarters to the US if Switzerland tightens capital requirements

25.11.2025Swiss banking giant UBS, which last year took over the troubled Credit Suisse and thereby became an even larger global financial player, has threatened that it could move its headquarters out of Switzerland – all the way to the United States – if Swiss authorities insist on drastically tightening capital regulations for banks. This announcement comes after controversies surrounding the takeover of Credit Suisse, including the write-off of CHF 16.5 billion worth of AT1 bonds, which sparked legal disputes and scrutiny of regulatory decisions.

Background: The takeover of Credit Suisse and the fate of AT1 bonds.

On March 19, 2023, UBS, with government support, took over its struggling rival Credit Suisse in an emergency rescue to prevent a collapse of the financial system. This created from the two largest Swiss lenders a financial “super-banking” conglomerate with over USD 5 trillion in assets – raising concerns about the stability of the economy if such a giant were to run into trouble. Part of the rescue package was the complete write-down of Credit Suisse’s AT1 bonds worth CHF 16.5 billion, which the regulator FINMA ordered to increase the bank’s capital. These AT1 (Additional Tier 1) instruments, introduced after the 2008 financial crisis, were designed to absorb losses in crisis situations. However, in the case of Credit Suisse, the decision was unprecedented – the bank’s shareholders received roughly USD 3.25 billion in UBS shares, while AT1 bondholders were left with zero value, contrary to the usual payout hierarchy, shocking the markets. This move sparked strong investor anger and a wave of lawsuits in Switzerland, the US, and other jurisdictions.

The legal consequences of this regulatory precedent are already visible. In October 2025, the Swiss Federal Administrative Court ruled that the decision to completely write off the AT1 bonds was unlawful, finding that severe interference with bondholders’ property rights occurred without a clear and formal legal basis. This ruling (still not final and expected to be appealed to the Supreme Court) has encouraged creditors to hope for at least partial compensation for their losses. Analysts estimate that even if bondholders receive damages, they are unlikely to recover the full nominal value, given that AT1 instruments were already trading below par before the bank’s collapse. Nonetheless, the message is strong: the conduct of Swiss authorities in the Credit Suisse case is now under scrutiny, which could have repercussions for UBS as well. Some legal experts note that FINMA’s controversial decision created an additional headache for UBS, which could paradoxically strengthen the bank’s position in lobbying against new strict rules – as authorities might feel a certain “moral obligation” to ease pressure on UBS, which bears the burden of that contentious write-off.

The UBS CEO’s statement and transatlantic negotiations

Shortly after the integration of Credit Suisse began, the Swiss government announced plans to further tighten regulations for systemically important banks. In June 2025, a package of 31 measures was proposed as part of the revision of the “too big to fail” framework, including one particularly controversial provision – that systemically important banks must fully cover with capital at the parent-bank level all their significant foreign subsidiaries. The proposals are targeted at the only remaining megabank in the country and have been informally dubbed the “lex UBS.” According to initial calculations, under these rules UBS would have to raise an additional ~CHF 19 billion (around USD 24 billion) of highest-quality capital (CET1) – on top of the already planned ~CHF 18 billion needed due to the Credit Suisse acquisition. Overall, there was talk of as much as CHF 26 billion in additional capital UBS would have to maintain. UBS’s management fiercely opposed these requirements, calling them excessive and harmful. CEO Sergio Ermotti warned that the proposed rules in their current form “won’t work for us” and are unacceptably stringent, as they would undermine the competitiveness of both the bank and the entire Swiss financial center. “We want to remain a Swiss bank, but these rules simply don’t work for us,” Ermotti emphasized, calling the situation “quite serious.” He hinted that UBS is considering alternative steps if no solution is found and called on authorities for a compromise that would strengthen the financial system without jeopardizing the bank’s international competitiveness.

In this context, information leaked to the public in late 2025 that UBS is considering relocating its headquarters out of Switzerland if the government does not abandon the strictest regulations. Citing anonymous sources, the American newspaper New York Post reported in September that a UBS delegation led by Chairman Colm Kelleher and CEO Sergio Ermotti held a series of meetings with US officials. The topic was the potential relocation of UBS Group’s central headquarters to the United States, with the possibility discussed that UBS might acquire a mid-sized US bank as part of that move. According to these reports, potential acquisition targets included PNC Financial Services or Bank of New York Mellon, which would give UBS a strong foothold in the US in exchange for moving its corporate headquarters across the Atlantic.

These rumors caused significant attention and concern both in Switzerland and in international financial circles. In November 2025, the Financial Times further reported that Kelleher had privately spoken with the US Secretary of the Treasury (allegedly Scott Bessent) about what the technical process of moving UBS to America would look like. Sources suggest that the US government signaled readiness to attract the Swiss banking giant – with reports that President Donald Trump’s administration views such an outcome favorably. These high-level contacts indicate that UBS is seriously exploring a “Plan B” while simultaneously playing a tactical pressure game with Bern.

UBS, for its part, is publicly trying to calm tensions. In response to media reports, the bank emphasized that it “wants to continue operating successfully as a global bank from Switzerland.” A UBS spokesperson declined to comment specifically on reports about meetings with US officials and intentions regarding relocation, calling such discussions speculative. She referred to Ermotti’s earlier statement that it is “too early to comment on any potential scenarios or the bank’s responses to genuinely punitive and excessive demands” from regulators. This carefully worded response suggests that UBS is leaving the relocation option open but is using it primarily as a negotiating tool while seeking more favorable conditions at home. Swiss authorities, for now, remain firm – the President of the Confederation and Finance Minister Karin Keller-Sutter said, in response to speculation about UBS’s departure, that the bank’s headquarters location is not something decided by the federal government, adding that the threat of leaving is “not new” in their negotiations. Her comments hint at a degree of fatigue with the bank’s pressure tactics, but also a determination to pursue reforms that the public considers necessary after the Credit Suisse collapse.

Consequences of a potential UBS headquarters relocation

The possibility that UBS – an icon of Swiss banking – could leave Switzerland raises numerous economic, political, and reputational questions. First, the economic implications for Switzerland would be significant. UBS is one of the largest employers in the country’s financial sector and a key driver of banking activity in Zurich and Geneva. Although UBS would certainly retain a major operational center in Switzerland even after relocation (since it continues to manage extensive domestic business and Swiss clients’ assets), the loss of the corporate headquarters would mean that key decision-making functions, and likely some high-ranking jobs, would move overseas. This could also affect tax revenues – UBS currently pays taxes as a Swiss corporation, whereas in a relocation scenario, most taxation would shift to the US. In the long run, Zurich’s financial center could lose part of its international prestige and influence if UBS were no longer domiciled there as a global bank. Experts warn that such a development “would undermine confidence in the Swiss financial sector” and signal to investors that the regulatory environment in Switzerland may be becoming too unpredictable or hostile for major players.

On the other hand, relocating UBS to the US would be a gain for the American capital market. New York (or another financial hub such as Charlotte or Pittsburgh if UBS acquired PNC Bank) would gain the headquarters of another globally important bank, which could strengthen the local market and create new investment opportunities. US authorities would likely welcome the arrival of such a financial giant as a confirmation of the competitiveness of their regulatory framework – although they would also have to take on supervision of an entity whose size (UBS Group’s balance sheet far exceeds Switzerland’s GDP) is critical on a global scale. This would mean greater responsibility for American regulators (Federal Reserve, SEC, etc.) to ensure the stability of an institution that is now “theirs.” Politically, UBS’s departure would likely cause turmoil in Switzerland. The Swiss parliament would come under pressure – some of the public would blame regulators and the government for going too far in pressuring the bank, while others would say it is unacceptable for a single institution to blackmail the state. Public opinion surveys already show a divided view: in one poll, about 61% of Swiss citizens supported stricter capital requirements for UBS even if stricter than elsewhere, while 67% simultaneously believed that UBS’s departure would harm Switzerland. These numbers reflect public frustration over the government-assisted rescue of Credit Suisse but also fear of losing the country’s flagship financial institution. Politicians will have to balance the demand for greater financial-system safety with the need to preserve the country’s attractiveness for business.

The reputational risk is also huge. Switzerland has spent decades building the image of a reliable financial center. The collapse of one major bank (Credit Suisse) already tarnished that image, and a scenario in which the remaining banking giant moves its headquarters abroad could be seen as a sign that Switzerland no longer offers a stable and predictable environment for the largest financial institutions. This could discourage potential investors and clients. UBS, on the other hand, would have to ensure that such a move does not damage the trust of its clients – especially wealthy individuals and families worldwide who traditionally value Swiss political neutrality and discretion. The UBS brand is deeply tied to Swiss heritage, and some analysts emphasize that “UBS without its Swiss base would no longer be UBS,” alluding to the fact that much of the trust the bank enjoys is rooted in its Swiss identity. Relocating the headquarters would inevitably raise questions about the loyalty of clients who chose the bank partly because of that reputation. At the same time, it is worth noting that UBS has long been a global institution – most of its revenue today comes from outside Switzerland (especially the US and Asia), while the domestic market is relatively saturated and slower-growing. From that perspective, moving corporate functions to the US could be seen as a natural step in the globalization of its business. However, Swiss regulators could respond with countermeasures: it is not excluded that they could make UBS’s operations in Switzerland more difficult if it “abandons” its homeland – for example, with stricter licensing requirements, limiting certain privileges, or other measures. Such a conflict would help neither side and would represent an additional reputational risk both for UBS and for the Swiss regulatory framework.

Expert views and the search for compromise

Legal and financial experts are divided about the realism and usefulness of UBS’s relocation. Many assess that the threat is primarily a negotiating tactic to pressure Swiss authorities. David Benamou, manager of the Axiom fund that invested in UBS, believes that the bank management’s reaction to political pressure is understandable but that actually relocating the headquarters would be counterproductive. “UBS is a global player, but its foundations are Swiss – the brand and trust it enjoys worldwide are tied to Switzerland. UBS without a Swiss base would not be UBS,” Benamou says. He adds that the idea of leaving “makes sense on paper” because US regulation might be more favorable in terms of capital computation, but warns that Switzerland could retaliate and make life difficult for the bank, and that entering deeper into the US market carries its own challenges, given that US regulators are very strict and competition is strong. Other analysts share this view, noting that relocating a bank of this size is not a simple undertaking – it would require approvals from numerous regulators (Swiss, US federal and state), changes to the holding-company structure, and convincing shareholders that it is in their interest. We have not yet seen an example of a global bank of this scale changing its domicile, so UBS would step into uncharted territory.

Experts in banking law also point to the paradoxical side of the regulatory dilemma UBS finds itself in. Professor Hans Gersbach of ETH Zurich notes that even if UBS ultimately has to compensate part of the losses to AT1 bondholders (if FINMA’s appeal fails), the amount is unlikely to be the full CHF 16 billion because the market value of these securities was never that high during the crisis. Thus, the financial burden for UBS could be limited, and Swiss authorities might bear part of the cost if their decision is proven unlawful. Meanwhile, Professor Peter V. Kunz of the University of Bern states that the court’s AT1 ruling has somewhat “softened” public and political attitudes toward UBS, as it showed that the regulators’ actions may have been too harsh. “This could earn UBS some sympathy in its efforts to negotiate lower capital requirements,” Kunz says. In other words, space for compromise is opening. Indeed, recent signals from all sides suggest a willingness for a deal. Reuters reported in October that both Bern and UBS management, in private talks, show readiness for compromise so that parliament ultimately adopts softened requirements acceptable to both sides. In expert circles, it is mentioned that the final additional capital required from UBS could be reduced to 4–7 billion CHF, instead of the originally discussed 20+ billion, bringing Swiss requirements closer to those in the European Union.

From today’s perspective, it is clear that neither UBS nor Swiss authorities truly want to reach a breaking point. UBS, despite its global footprint, remains the pride of the Swiss financial industry and a key pillar of its economy. On the other hand, Switzerland is for UBS a unique home that provides a stable legal system, skilled workforce, and a reputation that is hard to replicate elsewhere. A compromise – in the form of reasonable capital rules that strengthen the bank’s resilience without placing it at a disadvantage relative to competitors – seems the most likely outcome. This would allow UBS to continue operating globally from its traditional headquarters in Zurich, which bankers often cite as the preferred scenario, while giving the Swiss public and politicians assurance that the collapse of Credit Suisse will not happen again. Nonetheless, the UBS case is becoming a study from which other countries will learn: balancing strict regulation for financial stability with maintaining the competitiveness of national champions in the global arena is proving to be a delicate task with far-reaching consequences.

/ / /

"Standard Prva" LLC Bijeljina is a company registered in Bijeljina at the District Commercial Court in Bijeljina. Company’s activities are accountancy, repurchases of receivables, angel investing and other related services. Distressed debt is a part of the Group within which the company repurchases the receivables, which function and are not returned regularly.

Lawyer’s Office Stevanović is the leading lawyer’s office in the region with the seat in Bijeljina. The LO abbreviation represents Lawyer’s Office of Vesna Stevanović and Lawyer’s Office of Miloš Stevanović.

Contact for media press@advokati-stevanovic.com or via telephone 00 387 55 230 000 or 00387 55 22 4444.