"Strong Quarterly Results Driven by Trading Gains"

17.07.2025By Miloš Stevanović

The largest American banks achieved exceptionally strong financial results in the last quarter, which was reflected in yesterday’s stock market trading. Bank of America (BofA), JPMorgan Chase, Goldman Sachs, and other leading banks reported profit increases above analysts’ expectations, largely thanks to a surge in revenue from trading stocks and other securities. Market turbulence during the second quarter — from changes in trade policies to geopolitical tensions — increased volatility and trading volume, which provided a “tailwind” for the trading divisions of these banks. For example, Goldman Sachs achieved record revenues from stock trading — a 36% increase compared to the same period last year — which drove total quarterly profit up by 22%, exceeding Wall Street expectations. Similarly, Bank of America saw a 15% rise in sales and trading revenue, contributing to better-than-expected results. JPMorgan Chase and Citigroup also beat profit forecasts thanks to the “trading boom” — their trading divisions recorded double-digit revenue growth as clients adjusted portfolios to market conditions. At the same time, investment banking segments showed signs of recovery: Goldman Sachs reported 26% higher investment banking fees due to a revival of mergers and acquisitions, while Citigroup recorded a 13% increase in such fees, mostly driven by a jump in M&A activity. Although some banks’ investment banking services still lagged (Morgan Stanley, for example, reported a 5% drop in investment banking revenue), the overall picture for the sector was positive — market volatility turned into profit for Wall Street giants.

Interest rates and record net income

In addition to trading success, bank operations were supported by favorable interest rate movements. After a cycle of rate hikes, the Federal Reserve adopted a more moderate policy last year, and the rate cuts at the end of 2024 helped lower financing costs for banks. This enabled lenders to maintain wider interest margins — the difference between loan and deposit rates — which lifted net interest income to record levels. In the second quarter, Bank of America achieved record net interest income of $14.7 billion, a 7% increase from the previous year. JPMorgan also benefited from a high-rate environment and strong loan growth: the bank raised its net interest income forecast for all of 2025 to around $95.5 billion, up from ~$94.5 billion, signaling stronger-than-expected earnings from interest. Even with a slight dip in loan demand due to high interest rates, most large banks managed to maintain steady growth in their loan portfolios and deposits. Banks like Wells Fargo, however, became more cautious in their projections: after solid quarterly profits, Wells Fargo lowered its net interest income forecast for the rest of the year (expecting it to stay roughly flat compared to 2024), indicating that high rates are somewhat dampening loan demand and that more capital will be redirected to lower-yielding market operations. This announcement made investors cautious, which reflected in the bank’s share price. Still, overall, the high level of interest rates, accompanied by moderate deposit costs, continued to be a significant income source for banks — BofA, for example, has increased interest income for 13 consecutive quarters. Bankers emphasize that with stable growth in loans and deposits, they expect net interest income to remain strong in the second half of the year, assuming there are no dramatic changes in monetary policy.

Macroeconomic backdrop: from inflation to the Fed’s stance

Broader economic conditions also played a key role in results and market sentiment. Over recent months, investors have closely followed inflation data and policy moves. The latest reports suggest that inflation has picked up — consumer prices rose 0.3% in June on a monthly basis, the largest increase in five months (mainly due to higher prices of tariff-affected goods), while core inflation remained relatively moderate. Producer prices (PPI) were surprisingly unchanged in June, suggesting that inflationary pressures in the supply chain are partially offset by weakness in the services sector. This mixed inflation picture led the Federal Reserve to adopt a cautious stance. Market participants widely expect the Fed to keep the benchmark interest rate unchanged in the 4.25–4.50% range at its upcoming meeting in late July, until there’s more clarity on how tariffs are affecting price growth. Minutes from the previous Fed meeting showed that only a few officials advocated for rate cuts in the near term, while most supported pausing the cycle until inflation prospects become clearer.

On the political front, trade war rhetoric continues — President Donald Trump in April announced sweeping tariffs on imports from key economic partners, which initially shook markets and temporarily slowed corporate investments. Paradoxically, these tariffs and uncertainties increased volatility in financial markets, which — as we’ve seen — short-term boosted trading revenues for banks. By the end of the quarter, the situation partially stabilized: companies adapted to the new environment, and bankers report renewed client activity. For instance, in June there was an “unfreezing” of major mergers and acquisitions; several multibillion-dollar deals were announced or finalized, creating optimism that the second half of the year could bring more such transactions.

Tensions between the White House and the Fed also marked the previous day. Markets briefly reacted negatively yesterday to media reports that Trump was considering removing Fed Chairman Jerome Powell, which caused stock indices to fall and gold prices to spike during the morning. Although Trump quickly denied plans to fire Powell — while repeating criticism that the Fed should cut rates faster — this episode reminded investors of how important central bank independence is for market stability. Analysts note that any interference with Fed autonomy would undermine confidence in the U.S. economy and the dollar. For now, however, the Fed remains on a “wait and see” course — focused on domestic economic data and trying to balance stronger inflation signals on one side and growth threats (such as trade disputes) on the other. This steady approach from the central bank, without abrupt changes, offers predictability that benefits the financial sector, allowing banks to plan operations in a relatively stable monetary environment.

Market reaction and implications for investors

Investor reaction to these developments was generally positive, although varied across individual banks. The financial sector outperformed the broader market yesterday, driven by strong banking results and easing Fed-related fears later in the day. The S&P 500 index rose 0.3%, while the Dow Jones gained 0.5%, led by bank and financial stocks. The Nasdaq index added 0.26% and hit a new record — its fifth record in the last six sessions.

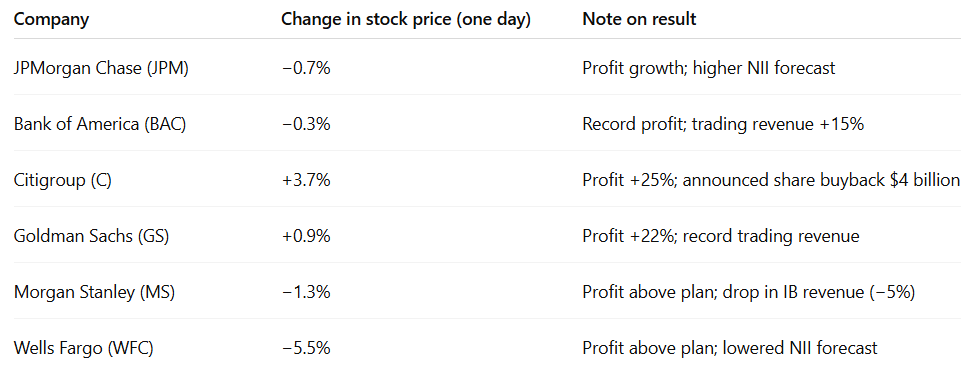

Among individual bank stocks, performance was mixed (Table 1). Goldman Sachs ended trading nearly 1% higher yesterday following its impressive profit jump. Bank of America, despite record profits, slipped about 0.3% — which analysts attribute to the fact that earlier price gains had already priced in some good news, leading to a “sell the news” reaction. In contrast, Morgan Stanley’s shares came under more pressure, falling about 1.3%, as its investment banking results disappointed and the market nervously reacted to the Fed rumors during the day. JPMorgan Chase remained relatively stable — it reported strong results a day earlier, with its stock sliding slightly (-0.7%) after earnings, despite raising interest income guidance. On the other hand, Citigroup was the standout among financial stocks: on Tuesday, after a stellar report and a share buyback announcement, it jumped 3.7%, briefly reaching its highest level since 2008. Wells Fargo fell about 5.5% — although it beat profit expectations, it lowered its interest income forecast, which concerned the market. These mixed moves indicate that investors rewarded banks that surprised on the revenue side (especially those announcing buybacks or dividends), while penalizing those with more cautious outlooks.

Table 1: Stock performance of major banks (as of July 16, 2025)

NOTE: The changes shown in the table reflect the movement of stock prices during the last trading day (July 15 or 16, 2025, depending on the earnings release date).

From the beginning of the year, the shares of most of these banks have recorded solid growth, following the upward trend of the broader market. The S&P 500 Banks Index strengthened by nearly 1% after the Fed’s stress test results were released at the end of June, and overall, this index is outperforming the broader S&P 500 index in 2025. Some banks have posted impressive gains: by mid-July, Goldman Sachs had accumulated +23% year-to-date, ranking among the top five performers in the S&P 500 financial sector. Wells Fargo is also up around 12.5% this year, while Bank of America has grown more modestly (around 4% year-to-date), lagging behind competitors and the banking index. The relatively moderate growth in BofA’s stock is explained by lower market expectations — but that, in turn, leaves room for its latest strong results to potentially increase the attractiveness of its shares in the coming period.

For investors, the current situation carries a dual message. On the one hand, the major players in American banking are demonstrating resilience and the ability to profit even under challenging conditions — as confirmed by the recent Fed stress test, in which all 22 largest banks received a “green light” and were assessed to be capable of withstanding a severe recession while maintaining capital. This strong capital position has opened the door for significant shareholder payouts: bank boards are rapidly announcing higher dividends and share repurchase programs. JPMorgan Chase, immediately after the test results were announced, approved a new $50 billion stock buyback program and announced an increase in its quarterly dividend. Citigroup plans a buyback of at least $4 billion in the third quarter, while Goldman Sachs announced a $1 per share dividend increase starting next quarter. These decisions send a positive signal — excess capital is being returned to shareholders, which in the short term boosts interest in bank stocks and supports their growth.

On the other hand, experts warn that the improved outlook has already been largely priced into these stock values, raising questions about the sustainability of further rapid growth. After a strong rebound in the financial sector in the first half of the year, the valuations of some banks have reached a premium compared to historical averages. “While we remain optimistic about the growth of bank earnings and continued improvements in profitability, we believe that outlook is already largely reflected in current prices, which limits short-term upside potential,” said David Waggoner, portfolio manager at Aptus Capital Advisors. Additionally, there are broader risks on the horizon: JPMorgan CEO Jamie Dimon pointed out that despite robust consumer spending and a healthy economy, “significant risks” remain — from uncertainties around tariffs and trade disputes, to geopolitical tensions, high government debt, and inflated asset prices. If some of these risks were to materialize (e.g., a further escalation of the trade war that suppresses business activity or a new wave of inflation that triggers rapid monetary tightening), banks could face challenges such as higher credit losses or narrowing interest margins.

For now, however, the market tone remains mostly positive. The financial sector has shown resilience and adaptability: American consumers continue to spend, companies are returning to investment and acquisition plans, and banks are managing risks and capital successfully. The combination of solid quarterly earnings, a moderate macroeconomic environment, and a friendly regulatory framework (including the Fed’s proposals to ease some capital requirements for large banks) is creating conditions in which the biggest banks are simultaneously increasing profitability and returning value to shareholders. Investors will, therefore, closely monitor the continuation of the earnings season and the next steps from the Federal Reserve. If the current trend continues — with controlled inflation, stable interest rates, and further growth in business activity — financial institutions could remain among the key stock market winners in the upcoming period. On the other hand, analysts continue to warn that “there is no room for complacency”: high valuations demand that banks continue to deliver top-tier results, or else the market will quickly respond with a correction. For now, large U.S. banks have shown they can turn even turbulent times to their advantage — achieving significant gains in the stock market the previous day and giving investors reason for cautious optimism.

Sources: Bloomberg, CNBC, Financial Times, Reuters (as referenced in the text).

/ / /

"Standard Prva" LLC Bijeljina is a company registered in Bijeljina at the District Commercial Court in Bijeljina. Company’s activities are accountancy, repurchases of receivables, angel investing and other related services. Distressed debt is a part of the Group within which the company repurchases the receivables, which function and are not returned regularly.

Lawyer’s Office Stevanović is the leading lawyer’s office in the region with the seat in Bijeljina. The LO abbreviation represents Lawyer’s Office of Vesna Stevanović and Lawyer’s Office of Miloš Stevanović.

Contact for media press@advokati-stevanovic.com or via telephone 00 387 55 230 000 or 00387 55 22 4444.