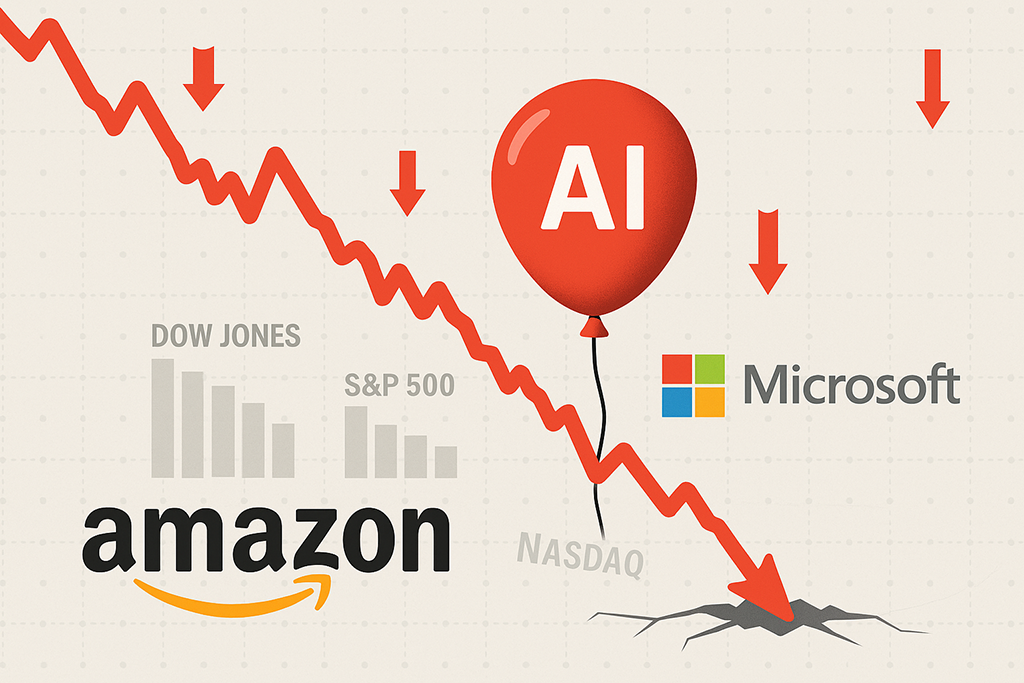

Panic on the market: Why Amazon and Microsoft are sinking – fear of an AI bubble triggers a mass sell-off

19.11.2025Written by: Miloš Stevanović

Global stock markets have been gripped by unease as fear of an inflated “AI bubble” fuels a mass sell-off of technology stocks. Share prices of giants such as Amazon and Microsoft have dropped sharply – Amazon lost more than 4% of its value during the day, while Microsoft fell by almost 3%. These steep declines also dragged broader indices downward: the Dow Jones weakened by about 500 points (around 1%), the S&P 500 by about 0.8%, while the tech-heavy Nasdaq plunged around 1.2%. Investors are rapidly abandoning risky positions, suggesting a sudden shift from euphoria to caution.

Analysts point to growing investor anxiety over a possible formation of an artificial-intelligence bubble – a situation in which valuations of AI companies rise faster than real-world results can justify. In recent years, technology stocks have been the main engine of growth, driven by expectations that AI would bring a revolution to all sectors. Parallels with the late-1990s dot-com era are being drawn more and more frequently, when many internet companies had astronomical valuations without sustainable business foundations. Similarly, today a handful of tech giants carry the weight of the entire market – the so-called “Magnificent Seven” (Alphabet/Google, Amazon, Apple, Meta, Microsoft, Tesla, and Nvidia) make up a record-high share of the S&P 500 index’s total value. Such concentration worries economists: if enthusiasm around AI weakens, the consequences could spill over to the entire market.

The key driver of the latest downturn is fear that expectations of AI technology are inflated, while the short-term benefits remain uncertain. The world’s largest tech companies have invested colossal sums in the development of AI infrastructure – hundreds of billions of dollars in data centers, chips, and supercomputers – but the financial effects of these investments are still unclear. “Tech firms have to spend a lot in order to keep up with rising demand, but that demand has not yet turned into profit or any significant productivity. Investors are becoming skeptical,” market analysts point out. In other words, the fear is that companies are pouring vast resources into AI without clear evidence that these investments will pay off in the foreseeable future.

Investor caution has been further heightened by moves from investment houses that are downgrading their recommendations for shares of the largest tech companies. Analysts warn that investments in new AI infrastructure – such as specialized GPU clusters – cost several times more than traditional cloud systems, but are not yet generating proportionate revenue. In their view, the market has given tech giants “too much credit” by assuming that massive AI expenditures will pay off as well as previous investments in cloud businesses, which is far from certain. Such assessments have cooled enthusiasm and prompted a re-evaluation of the high valuations of Amazon, Microsoft, Nvidia, and other leaders of the AI trend.

In a broader context, these upheavals mark a kind of turning point for the tech sector. For years, Big Tech companies have been the darlings of the stock market thanks to visions of an AI future. Their stocks have broken records, sustaining index growth despite occasional economic shocks. Today, however, investors are openly asking: is the AI revolution truly at hand, or is it a bubble of hope? And although tech giants have real revenues, unlike dot-com companies, projections of future earnings are now under a big question mark.

The market is increasingly demanding tangible results, not just big promises. If tech leaders do not soon demonstrate concrete profits from their AI investments, the sell-off wave could deepen. For now, the message from Wall Street is clear: the era of dizzying growth powered by expectations is ending – we are entering a phase in which demonstrable results, sustainability, and real value are required.

/ / /

"Standard Prva" LLC Bijeljina is a company registered in Bijeljina at the District Commercial Court in Bijeljina. Company’s activities are accountancy, repurchases of receivables, angel investing and other related services. Distressed debt is a part of the Group within which the company repurchases the receivables, which function and are not returned regularly.

Lawyer’s Office Stevanović is the leading lawyer’s office in the region with the seat in Bijeljina. The LO abbreviation represents Lawyer’s Office of Vesna Stevanović and Lawyer’s Office of Miloš Stevanović.

Contact for media press@advokati-stevanovic.com or via telephone 00 387 55 230 000 or 00387 55 22 4444.