StandardPrva Analysis: The Aviation Market in Serbia (2019–2024)

17.01.2026In the period 2019–2024, the Serbian aviation market went through significant ups and downs, with a rapid recovery after the COVID-19 pandemic and record results in 2023 and 2024. Commercial passenger traffic reached new peaks – Belgrade Airport exceeded 8 million passengers per year for the first time – while the regional airports Niš and Kraljevo also recorded growth and the introduction of new routes. The national airline Air Serbia strengthened its dominance in the domestic market by expanding its destination network and fleet, while foreign airlines (including low-cost carriers such as Wizz Air and Ryanair) continued to serve Serbia, adapting to new market conditions.

Private aviation in the form of business jet flights and charter operations is recording growth – domestic companies such as Air Pink and Prince Aviation are expanding capacity and fleet. Air cargo traffic shows a growth trend with the opening of direct cargo routes to Asia and an increase in the volume of goods transported by air. The report presents detailed statistical data on passengers, cargo transport, and business aviation, along with an overview of key market changes: the opening of new routes (including long-haul and cargo routes), the cancellation of some routes, changes in flight frequency, and strategic moves by leading players (such as the expansion of Air Serbia and adjustments to the strategies of LCC carriers). All of this is structured below through thematic sections, supported by tables, charts, and references to relevant sources.

Passenger traffic at commercial airports (2019–2024)

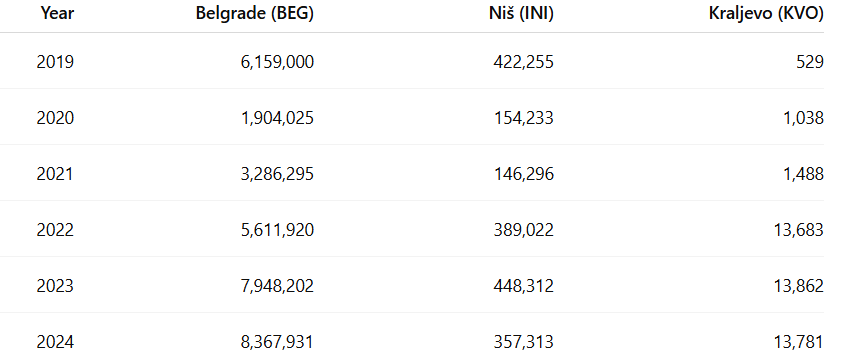

The pandemic caused a drastic decline in the number of passengers in 2020, but this was followed by accelerated recovery and growth. Belgrade Nikola Tesla Airport (BEG), by far the largest in the country, served over 6.15 million passengers in 2019 (9.2% more than in 2018). During 2020, the number of passengers fell by about 69%, to just 1.9 million. Already in 2021, a partial recovery was recorded (3.29 million, +73% compared to 2020), while in 2022 traffic jumped to 5.61 million passengers (an increase of 71% compared to 2021, which was ~8.9% below the 2019 level). The recovery was completed in 2023, when Belgrade Airport recorded 7,946,714 passengers – a new historical record, as much as 29% above the previous one from 2019. This trend continued in 2024: according to preliminary data, BEG handled around 8.37 million passengers (+5.3% vs 2023), thereby exceeding the threshold of 8 million annually for the first time.

The smaller Niš airport (INI), the second busiest in Serbia, reached its pre-pandemic record in 2019 with 422,255 passengers. This was followed by a sharp drop to ~154 thousand (2020) and a further slight decline to ~146 thousand (2021) due to pandemic restrictions. During 2022, Niš recorded a strong recovery with 389,022 passengers (more than doubling compared to 2021), and in 2023 it broke its own record with 448,312 passengers. This growth of ~15% in 2023 meant that Niš once again exceeded the 2019 level. However, preliminary data for 2024 indicate a decline – INI handled around 357,000 passengers (about 20% less than in 2023). The reduction occurred due to route rationalization by low-cost carriers (Wizz Air cancelled certain routes and temporarily reduced capacity to Niš), but at the end of 2024 and the beginning of 2025 the re-establishment of some services was announced (e.g. Wizz Air is returning the Niš–Dortmund route from January 2026, and Swiss restored the Niš–Zurich route at the end of 2023 after a four-year break).

Morava Airport Kraljevo (KVO) began commercial operations only in 2019 and currently has a relatively small traffic volume. In its first year (2019) it recorded only 529 passengers, while in 2020 and 2021 this number was around one thousand. A more significant increase occurred from 2022 (13,683 passengers), following the introduction of scheduled routes, primarily to Istanbul and Vienna. In 2023 traffic remained at a similar level (13,862 passengers), while in 2024 it slightly decreased to 13,781 passengers. Despite small absolute numbers, for Kraljevo this period represents exponential growth compared to the pioneering years – for example, 2022 had almost 10 times more passengers than 2021. During 2025, growth continued to a record ~14,700 passengers, making “Morava” achieve its best result since establishment.

Table 1: Number of passengers at commercial airports in Serbia, 2019–2024

Source: official airport statistics (Belgrade Nikola Tesla Airport – VINCI, Airports of Serbia).

Visually, on the passenger traffic chart, a drastic drop in 2020 is immediately noticeable, followed by a strong recovery of BEG and INI airports by 2022, and record values in 2023. Belgrade dominates with over 90% share of the total number of passengers, while Niš generally holds ~5–7%, and Kraljevo less than 1% (until 2022 practically negligible). Between 2019 and 2023, the total number of commercial passengers in Serbia increased despite the pandemic – from about 6.58 million (2019, sum of BEG+INI+KVO) to over 8.4 million (2023), which is an increase of ~28%. Thus, in 2024 Serbia emerged from the pandemic crisis with a significantly larger aviation market than ever before.

Airlines: national carrier and foreign (including LCC)

Air Serbia, the national airline and dominant actor in the Serbian market, successfully leveraged the recovery in demand and carried out an aggressive expansion during the observed period. As early as 2019, Air Serbia held over 50% market share at Belgrade Airport (measured by seat capacity). After the pandemic, the company rapidly restored traffic and gradually assumed a leading position also at the regional level: during 2023–2024, it offered more seats than the previously largest low-cost competitor Wizz Air. Air Serbia carried 2.76 million passengers in 2022, and then achieved a record 3.55 million in 2023 (including scheduled and charter flights). In 2024, 4.44 million passengers were transported, which is a new maximum (+6% compared to 2023). The company also stands out for its strong summer charter program – in addition to converting some former charter routes into scheduled ones (e.g. destinations in Egypt, Greece, etc.), it continues to operate a large number of tourist charter flights each season with departures from Belgrade and Niš. Air Serbia grew in both fleet and destinations in 2023–2024: it introduced new routes within Europe, as well as long-haul flights (after the renewal of New York in 2016, routes to Tianjin in China were added at the end of 2022 and Chicago (ORD) from May 2023). Thanks to this strategy, Air Serbia became the largest airline in the entire former Yugoslavia region by offered seats in 2024, overtaking Wizz Air. The company also achieved notable financial success – in 2023 and 2024 it operated with record profit.

In addition to the national carrier, more than 20 foreign airlines actively operate in the Serbian market. Among regular legacy carriers, almost all major European airlines are present, connecting their hubs with Belgrade: Lufthansa (Munich, Frankfurt), Austrian Airlines (Vienna), Swiss (Zurich, restored in 2023), Air France (Paris, re-established with the arrival of VINCI), KLM (Amsterdam), Turkish Airlines (Istanbul IST), LOT Polish (Warsaw), Aegean (Athens), ITA Airways (Rome), Tarom (Bucharest), and others. Also, from Russia until February 2022, Aeroflot (Moscow) and Nordwind (Severstal) operated flights – these were suspended due to geopolitical developments, while Air Serbia remained the only operator to Russia during 2022–2023 (with increased demand on those routes). Among Middle Eastern and intercontinental carriers, it is worth highlighting that Qatar Airways restored daily Doha–Belgrade flights during 2023 (after a pause), Flydubai has been present for years with two daily flights to Dubai, and Hainan Airlines introduced a direct Belgrade–Beijing (Urumqi) route once weekly in 2022, marking the first time after a long pause that a Chinese airline operated to Serbia.

The participation of low-cost carriers (LCC) is particularly significant, as they contributed to strong traffic growth at secondary airports and enabled more affordable flights to a range of destinations. Wizz Air is the largest LCC operator in Serbia: it has based aircraft in Belgrade (2 aircraft) and until 2020 had smaller bases in Niš as well. From Belgrade, Wizz Air operated about 10 routes during 2019, and by 2023 the number of destinations increased (including routes to several cities in Germany, Scandinavia, Italy, as well as London Luton, Abu Dhabi, etc.). In Niš, Wizz Air was also long the main carrier (flights to Basel, Memmingen, Malmö, Dortmund, etc.), but at the end of 2023 it reduced its presence in Niš due to a fleet constrained by technical issues and strategic redirection – Wizz closed its base in Tuzla and cut capacity at other ex-YU airports as well, so Niš experienced a decline in the number of flights in 2024. Nevertheless, Wizz remains the key LCC player in Serbia and plans expansion in 2025: the re-establishment of the Niš–Dortmund route has been announced, as well as new routes from Belgrade to Italy.

Ryanair, the largest European low-cost carrier, did not fly to Serbia for many years because it considered conditions at BEG airport expensive. Instead, it focused on nearby airports (Budapest, Timișoara, Niš, Banja Luka). From 2019, Ryanair began operations in Niš, where it at one point flew to several destinations (e.g. Berlin, Bratislava, Milan Bergamo). During 2020–2021, some of these routes were paused, while in 2022–2023 Ryanair reactivated certain routes to Niš (e.g. Vienna, Bergamo). However, even in 2024 Ryanair still has no routes to Belgrade. It is possible that this will change in the future if airport charges or strategy are aligned, but for now Wizz Air has retained primacy among LCCs in the capital. In addition, easyJet (occasional Geneva–Belgrade route, seasonal), Pegasus Airlines (Istanbul SAW – Niš, launched in 2022, and plans toward Belgrade), Vueling (occasional seasonal Barcelona–Belgrade flights), and Eurowings (Stuttgart and Cologne to Belgrade) are present. These low-cost carriers complement the network and provide competition on certain routes, which contributed to a reduction in average ticket prices in Serbia by ~27% between 2011 and 2023.

At Niš Airport, in addition to Wizz Air and Ryanair, other foreign airlines are periodically present thanks to state subsidies for routes of public service obligation (PSO). The Government of Serbia awarded Air Serbia a contract in 2019 to operate 12 subsidized routes from Niš to European cities (twice weekly to Nuremberg, Frankfurt, Rome, Budapest, Ljubljana, etc., and seasonally to Tivat) through 2023. At the same time, Ryanair, Swiss, and Wizz Air independently flew to ~10 destinations from Niš. After the expiration of the PSO program in 2023, Air Serbia continues some of these routes commercially (e.g. Niš–Ljubljana), while others were suspended pending new tenders or interest from low-cost carriers. Swiss, for example, restored the Zurich–Niš route in December 2023 after a multi-year pause, indicating that there is interest from traditional European airlines in secondary airports when market conditions exist.

Kraljevo (Morava) has a significantly smaller traffic volume, but Air Serbia and foreign carriers also play a role there. Air Serbia launched the first route from Morava to Vienna in 2019 (several times weekly), with seasonal flights to Thessaloniki and Tivat later. The most important route, however, is Istanbul, launched in 2021 – operated jointly by Air Serbia and Turkish Airlines (code-share cooperation). This connected Kraljevo to one of the largest hubs (IST), driving traffic growth. Charter flights are also occasionally operated from Morava (e.g. in August 2025 the largest aircraft to date landed – a Boeing 737-300 from Jordan, bringing a sports team to a tournament). In the future, the introduction of an additional low-cost carrier to Kraljevo is being considered, but infrastructure and demand limitations mean that Morava will likely remain a niche regional airport.

Cargo air transport: statistics and trends

Air cargo transport in Serbia represents a smaller, but important part of the market, primarily concentrated at Nikola Tesla Airport. According to an IATA report, around 14,100 tons of goods were transported by air through Serbian airports in 2023. With this, Serbian air cargo returned close to the level of the best years before the COVID-19 pandemic. (For comparison, in 2018 approximately 25,500 tons passed through BEG, which was a record value thanks to transit cargo and charter flights that year. In the meantime, changes occurred in methodology and the market, and part of the cargo was redirected to surrounding hubs.)

Belgrade Airport handles the lion’s share of total cargo (over 98%). During the 2020 pandemic, passenger aircraft flew less, but demand for air freight increased (transport of medical equipment, e-commerce, etc.). At that time, Belgrade had more ad-hoc cargo charters (including large aircraft such as the Antonov An-124 for the delivery of medical supplies from China). Nevertheless, overall figures in 2020 declined compared to 2019. After that, growth was recorded: 2021 and 2022 brought an increase in cargo traffic following the economic recovery. Air Serbia Cargo, as a dedicated segment of the national carrier, transported around 5,710 tons of cargo in 2022, and already 7,144 tons in 2024 (+25% compared to 2023). This includes belly cargo on Air Serbia’s passenger flights, as well as dedicated cargo arrangements. In addition to Air Serbia, many foreign airlines also offer cargo capacity at BEG through combined operations – for example, Turkish Airlines, Lufthansa, Qatar Airways and flydubai transport significant amounts of goods in the holds of scheduled passenger flights to Belgrade.

Among dedicated cargo operators, the following are active at Belgrade Airport: DHL Aviation (daily night cargo flight to Leipzig with a B757F), UPS (flights to Cologne/Basel), TNT/FedEx (to Liège), and since 2023 UPS/FedEx jointly use flights after FedEx shut down its own route. ASL Airlines (a European cargo charter company) is also present, occasionally operating flights for courier services. Notably, at the end of 2023 a direct cargo route from China was introduced: the Chinese airport of Ürümqi was connected with Belgrade once a week by a cargo aircraft (operated by the Uzbek company My Freighter). This is the result of agreements between the airport and Chinese partners and the free trade agreement between Serbia and the People’s Republic of China, and the Ürümqi–Belgrade route enables goods from China to reach Serbia much faster by air. Each of these flights transports around 50 tons of cargo from China, intended not only for Serbia but also for surrounding countries. With this, Belgrade has become one of the logistics hubs within the “Belt and Road” initiative.

Niš Airport has also attempted to position itself as a cargo center for southern Serbia, but with mixed results. During the 2010s, Niš attracted several cargo operators (for example, Turkish Cargo operated an A310F to Niš for a period in 2017, DHL briefly had a route, and in 2017 a record 2,537 tons of cargo passed through Niš). However, after that a decline followed – certain cargo flights were transferred to larger airports, and in 2022 Niš handled barely 92 tons of cargo, and only 70 tons in 2023. Only in 2024 did Niš experience a “cargo revival”: the first regular cargo route China–Niš was established (Ürümqi–Niš, also in cooperation with My Freighter). Flights started in July 2024 once a week, on the route Ürümqi–Navoi–Niš–Leipzig–Tashkent. By the end of 2024, thanks to this, Niš achieved a +510% increase in cargo (to around 425 tons annually). The plan is for Niš to become a regional distribution center for Chinese goods in the Balkans in the future. Niš Airport has the advantage of lower fees and less congestion, so it can attract cargo flights that do not require a large commercial center such as Belgrade.

Kraljevo currently does not have significant cargo traffic (apart from individual departures by small aircraft – e.g. export of agricultural products by light aircraft or similar). Infrastructure exists (a 2,200 m runway, a new terminal), so in the future KVO is not excluded from specialized cargo routes if an industrial zone were to open in the surrounding area.

In short, the trend in the cargo segment is upward: the total cargo market in 2024 surpassed the pre-pandemic volume. Serbia ranks 109th in the world by air cargo volume (out of more than 200 countries) and 67th on the list of trading markets. This shows that although Serbia is not among the largest cargo markets, air freight plays a key role for certain sectors (express delivery, pharmaceuticals, high-value electronics, fresh food products, etc.). Further strengthening of cargo connections – especially towards the Far East and North America – could contribute to Serbia becoming a broader logistics hub, with the first steps already visible through the mentioned Chinese routes.

Key changes in the market (2019–2024)

The last five years on the Serbian air market have been marked by dynamic changes. Below are the most important events and strategic changes:

Entry of the concessionaire and modernization of BEG airport (2019–2023):

At the beginning of 2019, Belgrade Airport was given under concession to VINCI Airports for 25 years. The new operator immediately started a major investment cycle – expansion of Terminal 2, construction of a new runway and taxiways, expansion of aprons and modernization of the airport’s entire capacity. As a result, BEG’s capacity was increased from around 5 million to over 15 million passengers per year, with significant service improvements. Modernization was largely completed by the end of 2023, coinciding with record traffic. VINCI also attracted new airlines (in 2019 Air France and KLM returned after a long absence, in 2022 Transavia France was brought in, etc.) and integrated Belgrade into its global marketing network.

COVID-19 pandemic (2020) and recovery:

As globally, the pandemic almost halted air traffic in Serbia from March to May 2020. Belgrade Airport was closed to passenger traffic for around two months, and Air Serbia operated only repatriation flights. This led to losses and restructuring – Air Serbia accelerated the retirement of older aircraft (B737-300), reduced the number of employees, but with state support overcame the crisis. In the second half of 2020, traffic slowly returned (especially to tourist destinations during summer, as “COVID passports” were introduced for Greece, Egypt, etc.). Niš and Kraljevo were practically suspended for most of 2020. Recovery started in 2021 and accelerated in 2022, when most restrictions were removed. The Serbian market proved more resilient than many European ones – due to the large share of diaspora and ethnic traffic (people visiting relatives) and tourist charters, traffic returned faster. By the end of 2022, Air Serbia restored its network to 95% of 2019 destinations, and LCCs returned even faster on some routes.

Expansion of Air Serbia (2022–2024):

After the pandemic, the national carrier implemented an ambitious growth plan. In 2022, more than 15 new routes were opened (including Chicago, Tianjin – the first direct flights to China after more than 30 years, as well as numerous European destinations: Valencia, Trieste, Palma de Mallorca, Sochi, Amman, etc.). In the summer season of 2023, Air Serbia flew to as many as 80 destinations on four continents, which is a historical maximum. The fleet was strengthened with additional Airbus A320 and ATR72 aircraft, and wide-body Airbus A330-200 aircraft were acquired for long-haul routes (a second A330 joined in 2023 for Chicago). Expansion was financially supported – in 2023 the company recorded a profit of €40.5 million, which was reinvested in development. The strategy proved successful: during 2023, Air Serbia transported more than half of all passengers in Serbia and significantly contributed to the growth of BEG airport. At the same time, Etihad Airways (a minority owner since 2013) sold its 49% stake back to Serbia at the end of 2023, making Air Serbia once again 100% domestically owned. This enables greater management flexibility and potentially new strategic partners in the future.

Changes among LCC carriers:

Until 2019, Wizz Air continuously expanded its bases in Serbia (based aircraft in BEG and INI) and had the largest share among foreign carriers. However, from 2020 to 2023, Wizz faced challenges (issues with Pratt & Whitney engines on the A320neo fleet, causing a global reduction in capacity). This was reflected in the region as well: in 2023 Wizz closed its base in Tuzla and reduced the number of aircraft in Niš (effectively shutting down the base, keeping flights but operated by aircraft based elsewhere). The consequence was a reduction in the number of routes from Niš (e.g. Malmö was discontinued, Dortmund temporarily suspended, and frequencies to Basel and Memmingen reduced in 2024). On the other hand, Ryanair became more aggressive in the region in 2021–2022 – it opened a base in Zagreb in 2021, increased its presence in Banja Luka, and announced flights to multiple destinations in the Balkans. For Serbia, this means Ryanair maintains pressure on Niš (where it still operates, albeit with modest volume), and the launch of flights to Belgrade is possible in the future if commercial conditions are met. Meanwhile, easyJet temporarily suspended its Belgrade route during 2020–2021, but restored it seasonally in 2022 and 2023 (Geneva and Basel). Pegasus from Turkey entered in 2022 with twice-weekly Istanbul SAW–Niš flights, competing with Turkish Airlines and Air Serbia on the Istanbul route (IST/SAW). Thus, the LCC market is being reconfigured: Wizz Air remains the main low-cost carrier in Serbia, but with somewhat reduced services outside Belgrade; Ryanair is watching for opportunities; others (Pegasus, easyJet, Vueling, Eurowings) fill niches.

Development of regional airports and PSO routes:

The state strategy of more balanced development of air traffic led to the takeover of management of Niš and Kraljevo by the state-owned company “Airports of Serbia” in 2019. Subsidized routes were introduced from Niš (12 Air Serbia routes, 2019–2023) and Kraljevo (from 2020 the Kraljevo–Vienna route with state support). These measures helped initiate traffic and connectivity of secondary cities. Niš thus retained air links with key destinations in Germany, Austria, Italy and the region, which would have been commercially difficult to sustain immediately. Kraljevo, in addition to Vienna, also had a PSO route to Istanbul (before the entry of Turkish Airlines). By 2023 most of these PSO contracts had expired, but some were renewed: for example, the Kraljevo–Istanbul route now continues commercially (thanks to Turkish Airlines codeshare), while Niš–Ljubljana and Niš–Budapest were continued by Air Serbia without additional subsidies. A new round of subsidies for Niš is planned from 2024 in order to introduce routes to additional important centers (Paris or Geneva are mentioned). These moves significantly improved air accessibility of southern and western Serbia, reducing pressure for all passengers to gravitate toward Belgrade.

New destinations and closure of old routes:

The period saw numerous flight inaugurations. In addition to the already mentioned Air Serbia destinations (22 new routes in summer 2023 alone), Wizz Air launched routes from Belgrade to Lyon, Stockholm, and Iceland (Reykjavík) in 2019 – some survived, others were discontinued (Iceland was cut in 2020). LOT launched Kraków–Belgrade in 2019 (seasonal). Luxair from Luxembourg started flights to BEG in 2023. Air Cairo began Sharm el-Sheikh charters from BEG in 2022. On the other hand, some routes were closed: Etihad Airways withdrew its Abu Dhabi–Belgrade route in March 2020 (after the pandemic interruption it was not restored; Air Serbia later took over the route in 2023). Swiss discontinued Geneva–Belgrade in 2018, easyJet discontinued Berlin–Belgrade in 2019. Norwegian Air Shuttle, which flew Oslo–Belgrade in 2019, ended the route in 2020 due to company restructuring. At Niš Airport, after the closure of the Wizz Air base, there were temporarily (2020–2021) no flights to Malmö and Dortmund, but later other carriers or new arrangements returned (e.g. Ryanair to Bergamo instead of Wizz).

Changes in frequencies and capacities:

As demand returned, airlines increased flight frequencies to Serbia. The Lufthansa Group in 2022 restored all flights to pre-2019 levels (Lufthansa to FRA and MUC 2–3x daily, Austrian 3x daily to VIE, Swiss 4x weekly to ZRH). Turkish Airlines in 2023 increased from 14 to 18 weekly flights to IST during the season, setting a capacity record on that route. Pegasus, seeing demand, increased Istanbul SAW–Belgrade from 4 to 7 weekly in 2022/23. Flydubai introduced larger B737 MAX aircraft on the Dubai route and increased to 14 weekly flights. Russian routes (Moscow, Saint Petersburg) had 7 weekly flights each until February 2022, after which they were reduced due to sanctions (only Air Serbia continued – daily Moscow and 2x weekly Saint Petersburg; later it added Sochi). Air Serbia significantly increased frequencies on its key routes: for example, New York increased from 2 weekly (2019) to 5 weekly (2023), London from daily to 10 weekly, Istanbul from daily to 10 weekly, etc. During summer 2023, Air Serbia exceeded 2019 levels on some routes (Athens 14x weekly, Larnaca 10x, Zagreb 14x, Skopje 17x, etc.). All of this resulted in better connectivity – the number of seats to and from Serbia in 2023 increased by around 40% year-on-year, following demand.

Strategic moves and partnerships:

In addition to ownership changes at Air Serbia (Etihad’s exit), it is important to mention connectivity strategies. During 2022–2024, Air Serbia entered multiple codeshare partnerships (with Air China, Turkish Airlines, ITA Airways, Luxair, Air Canada, etc.) in order to increase its global reach. Belgrade has thus increasingly positioned itself as a regional hub – growth in transfer passengers is recorded (where passengers from the Balkan region connect via BEG onward to the West or East). An example is the Belgrade–New York route, where a significant portion of passengers originate outside Serbia (especially from the region). SMATSA (air traffic control) and Air Serbia recorded the jubilee one-millionth operation since the establishment of the national carrier in November 2025, which symbolically illustrates the reach of Serbian aviation today.

In conclusion, the period 2019–2024 was extremely turbulent but also development-rich for the Serbian air business. After the decline in 2020, the market returned to a growth trajectory, with record results in passenger traffic and significant improvement of the offer (more routes, more carriers, a more modern airport). Key players – Air Serbia, VINCI (the airport), as well as LCC carriers – made moves that redefined the market and laid the foundation for further growth. Challenges remain (global economic trends, competition from surrounding hubs, sustainability of explosive capacity growth), but trends indicate that Serbia will continue to strengthen its position in regional aviation in the years to come.

/ / /

"Standard Prva" LLC Bijeljina is a company registered in Bijeljina at the District Commercial Court in Bijeljina. Company’s activities are accountancy, repurchases of receivables, angel investing and other related services. Distressed debt is a part of the Group within which the company repurchases the receivables, which function and are not returned regularly.

Lawyer’s Office Stevanović is the leading lawyer’s office in the region with the seat in Bijeljina. The LO abbreviation represents Lawyer’s Office of Vesna Stevanović and Lawyer’s Office of Miloš Stevanović.

Contact for media press@advokati-stevanovic.com or via telephone 00 387 55 230 000 or 00387 55 22 4444.